UFC star Khamzat Chimaev, known for his formidable presence in the ring, recently ventured into cryptocurrency, intending to capitalize on his popularity.

However, he faces allegations of insider trading related to his newly launched meme coin. He also has drawn the ire of the crypto community and raised serious questions about his financial activities.

Chimaev’s SMASH Coin Crashes After Initial Hype

Initially, Chimaev engaged his followers on X (formerly Twitter) by asking which cryptocurrency he should invest in. The very next day, Chimaev introduced his SMASH meme coin on the Solana (SOL) blockchain. He encouraged his fans to buy the SMASH meme coin, leveraging his famous catchphrase, “Smash ’em all.”

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Despite initial hype and promotional efforts on his social media, the asset’s price fell to zero soon after its release. The crypto community quickly accused Chimaev of orchestrating a pump-and-dump scheme. In the crypto market, a pump-and-dump scheme involves artificially inflating an asset’s price before selling off at a peak, leaving later buyers with devalued investments.

Data from GeckoTerminal revealed a staggering 72% drop in SMASH’s value within 24 hours, with a temporary plunge exceeding 96%. The meme coin’s market capitalization now stands at only $82,000. Moreover, its trading volume barely surpasses $116,000.

Moreover, all related tweets had been deleted at the time of writing. These add more suspicion surrounding the meme coin.

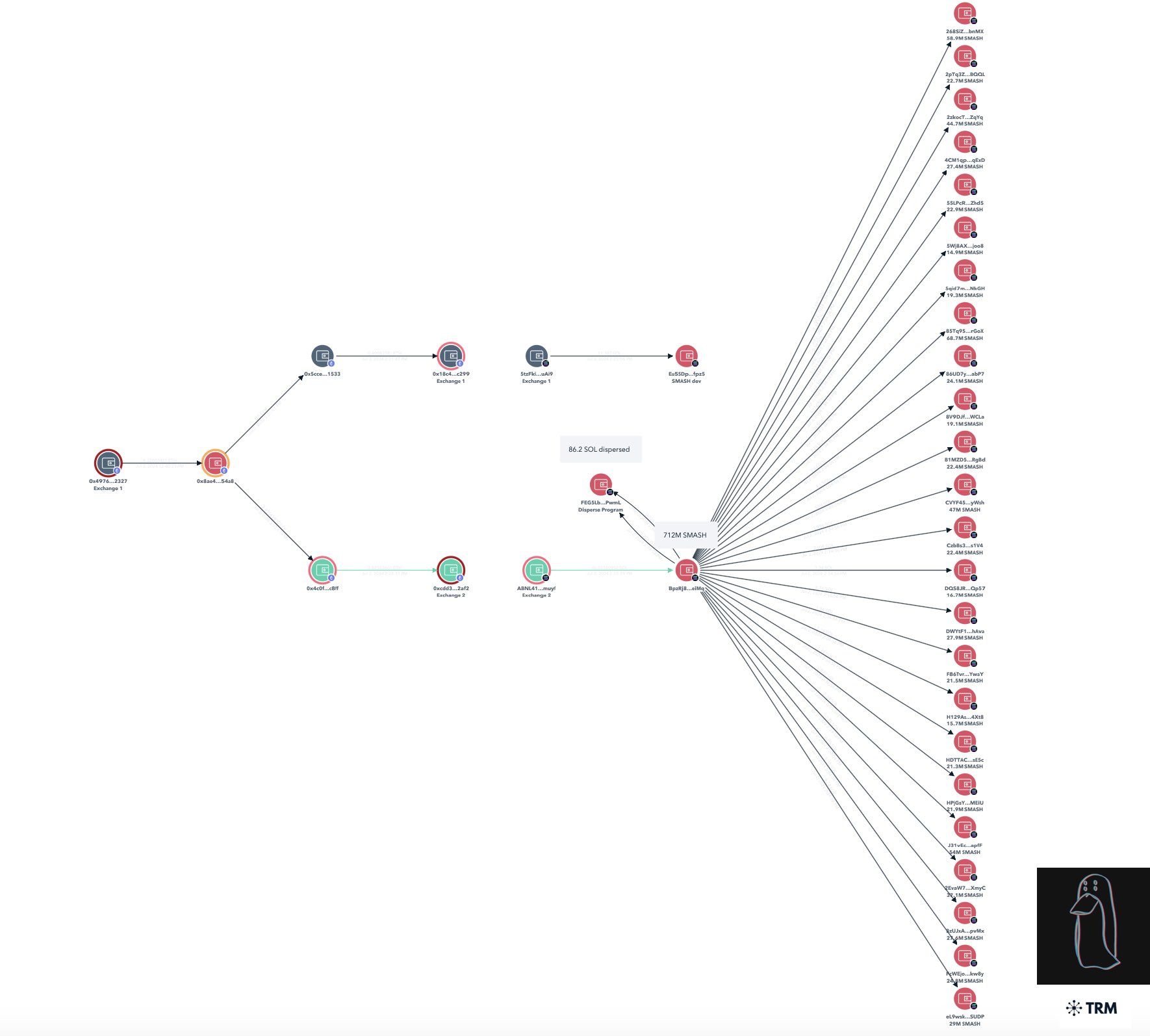

Prominent on-chain sleuth ZachXBT uncovered evidence suggesting insider trading on SMASH. He pointed out that insiders and wallets linked to the developers purchased up to 78% of the SMASH volume.

“Why do all of you instantly nuke your reputation with meme coin scams?” ZachXBT called out.

Furthermore, ZachXBT’s findings indicate that at least 71% of the coin’s supply has a direct connection with insider wallets funded from the same Ethereum address as the developer’s wallet on Solana. A total of 24 addresses collectively received 86.2 SOL, valued at around $11,500.

This amount was subsequently utilized to acquire 712 million SMASH tokens, representing 71.2% of the total available supply of SMASH tokens. These assets were dispersed among smaller addresses, further complicating the traceability of the transactions.

The incident with Chimaev’s SMASH coin is not an isolated case. The crypto market has witnessed a surge in meme coins launched by celebrities, often leading to similar controversies.

For instance, former Olympic athlete and Kardashian-Jenner family member Caitlyn Jenner faced accusations of fraud after launching her own coin. Similarly, confusion and deceit marred singer Iggy Azalea’s token release, as an unauthorized asset appeared on the market just before her official launch.

Read more: 15 Most Common Crypto Scams To Look Out For

Earlier in June, Ethereum co-founder Vitalik Buterin has criticized celebrity meme coins. Buterin emphasized that digital assets should serve meaningful purposes rather than simply enriching insiders.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Credit: Source link