Justin Sun’s USDD stablecoin officially launched on Ethereum, expanding beyond its native TRON blockchain to challenge Tether’s dominance.

The Ethereum launch coincides with the network’s stablecoin supply reaching a record $165 billion, creating an opportune moment for USDD to tap into the largest decentralized finance ecosystem while Tether maintains its $169 billion market cap lead.

USDD’s multi-chain deployment comes with an airdrop campaign offering up to 12% APY rewards for Ethereum holders, though the token faces strong headwinds given Tether’s 367 times larger market capitalization.

USDD’s Algorithmic Model Faces Ethereum Test

The TRON DAO Reserve’s stablecoin operates through overcollateralization, maintaining a 204.5% backing ratio, primarily supported by TRX tokens after Sun removed $726 million in Bitcoin collateral in August.

Following a comprehensive CertiK audit, the Ethereum deployment introduces a Peg Stability Module, which allows seamless 1:1 swaps with USDT and USDC to address liquidity concerns.

The mechanism builds on lessons from Terra’s algorithmic collapse, though USDD weathered major depegging events, including drops to $0.983 during Terra’s May 2022 implosion and $0.97 during FTX’s November collapse.

Meanwhile, the launch features tiered rewards ranging from 12% at low total value locked to 6% as adoption increases, with distributions occurring every eight hours through the Merkl Dashboard based on daily snapshots.

The contract address went live with immediate USDT and USDC swap functionality. Future plans include launching sUSDD as an interest-bearing version for passive yield generation.

Beyond DeFi integration, USDD’s Ethereum presence spans 10 blockchain networks, including BSC, Avalanche, and Polygon, supported by cross-chain bridges from Stargate Finance, Symbiosis, and DeBridge.

The deployment coincides with TRON’s broader ecosystem growth, including SunSwap maintaining $3 billion in monthly volume and JustLend experiencing a 23% increase in borrowing transactions compared to 2024 levels.

USDD Confronts Tether’s Trillion-Dollar Ecosystem

Tether’s supremacy appears virtually unassailable. Its daily trading volume exceeds USDD’s by a factor of 23,500 while maintaining near-universal exchange support across centralized and decentralized platforms.

In July, CryptoQuant data revealed that TRON surpassed Ethereum in USDT liquidity with $80.8 billion versus $73.8 billion.

USDT now processes over $24.6 billion daily on TRON alone through 2.3 to 2.4 million transactions, dwarfing most competing stablecoins’ total volumes across all networks.

This infrastructure advantage extends to reserve backing, where Tether claims 75.86% U.S. Treasury bills and 12.09% overnight repos, different from USDD’s volatile TRX-heavy collateral structure.

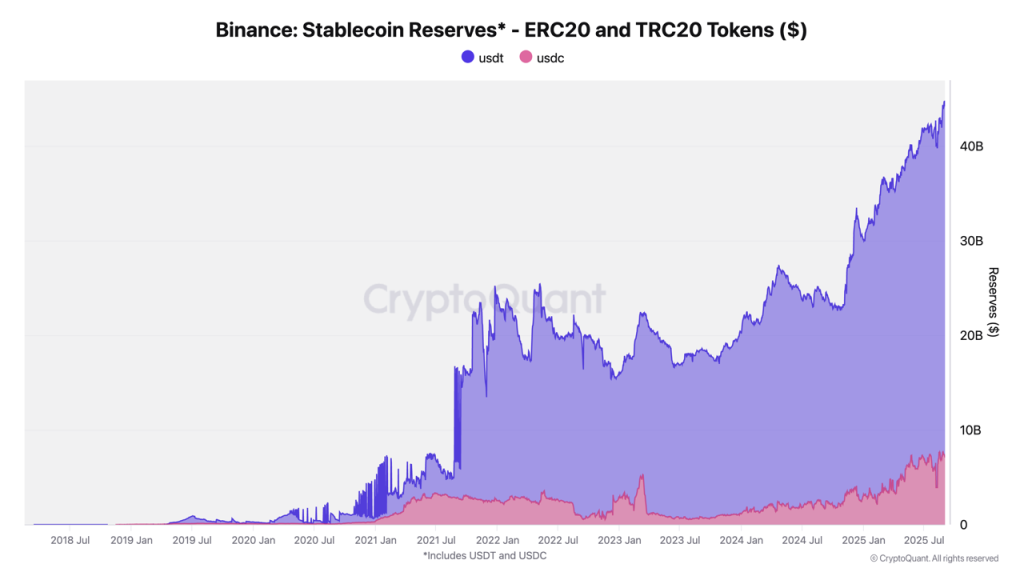

Meanwhile, Binance currently commands 67% of all exchange stablecoin reserves with $44.2 billion, including $37.1 billion in USDT and $7.1 billion in USDC.

Yet the stablecoin sector shows increasing fragmentation as Chainalysis reports $2.5 trillion in transaction volume sector-wide, with specialized players targeting specific niches.

So far, emerging competitors include MetaMask’s planned mUSD for wallet integration and Paxos’s USDH proposal offering 95% revenue sharing to token holders.

Smaller stablecoins have also demonstrated rapid growth trajectories, with EURC expanding from $47 million to $7.5 billion in euro-denominated transactions over the past year. Similarly, PYUSD accelerated from $783 million to $3.95 billion over the same period.

Additionally, regulatory clarity from the EU’s MiCA and the U.S. GENIUS Act creates opportunities for compliant alternatives to capture market share from established players facing ongoing scrutiny.

This regulatory environment benefits leading stablecoins like USDC, capturing institutional corridors, USDT dominating emerging markets as digital cash, and newer entrants targeting specialized use cases.

Industry projections suggest the sector is set to continue growing and could reach $1 trillion in annual payment volume by 2028, with Citigroup forecasting even more massive expansion to over $2 trillion market cap by 2030.

Credit: Source link