- The bullish pennant breakout signals upward potential, with $0.057 as the key resistance level.

- Market confidence rises with open interest at $88.23 million, RSI at 51.19, and solid metrics.

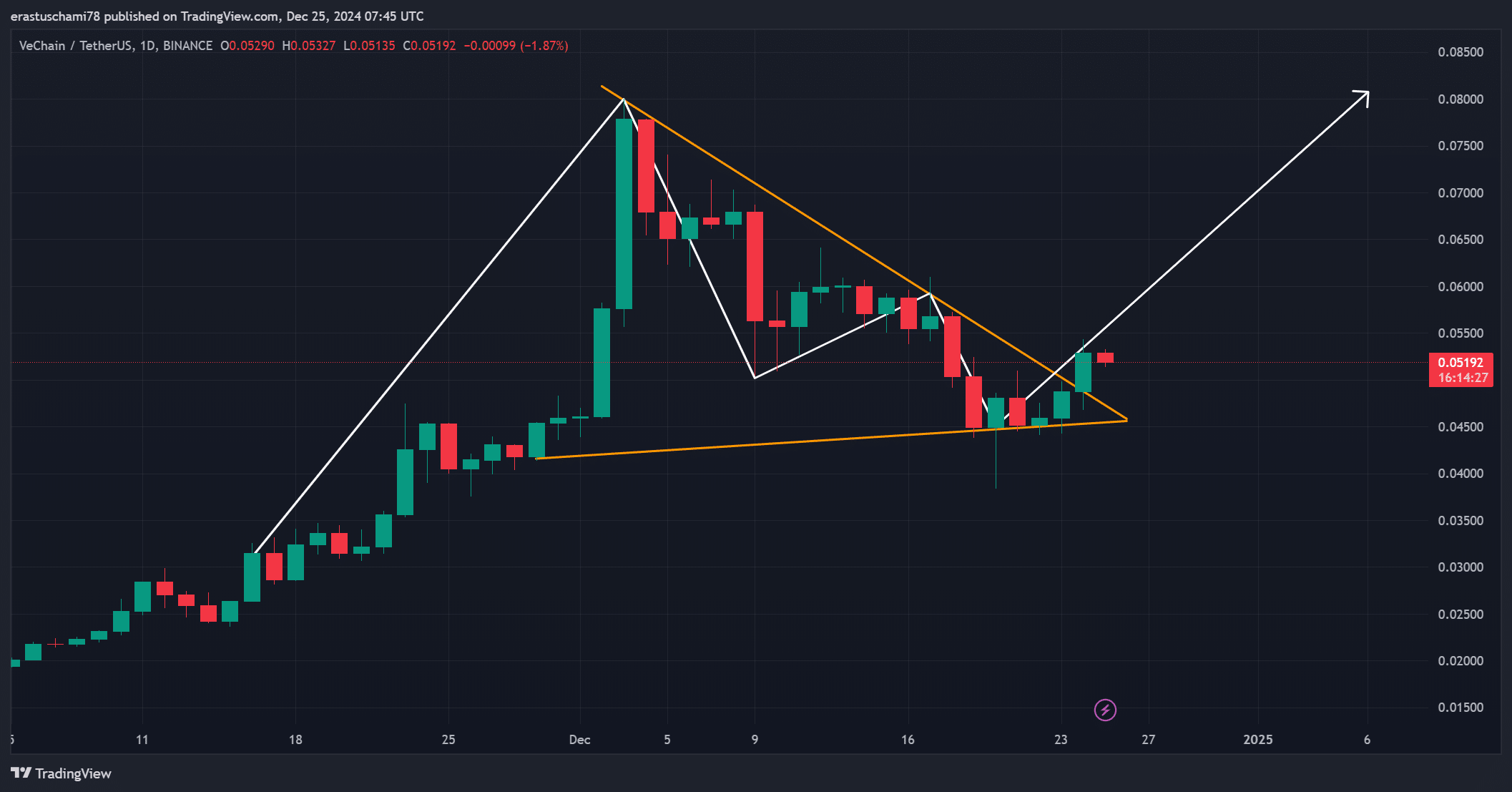

VeChain [VET] has captured market attention with its sharp breakout from a bullish pennant pattern, signaling a potential continuation of its upward trend after weeks of consolidation.

This breakout, driven by increased market interest and surging trading activity, marks a critical moment for VET as it trades at $0.05218, reflecting a 10.4% gain over the past 24 hours at press time.

With momentum building, the question arises: Can VeChain sustain this rally and challenge key resistance levels?

VET price action analysis: Bullish pennant flag breakout

The breakout from the bullish pennant pattern suggests strong upward momentum, and the accompanying 42.54% surge in trading volume reinforces confidence in the move.

The current resistance zone lies near the $0.057 level, which, if breached, could propel VET towards the $0.08 region as its next target.

However, traders should monitor price movements carefully, as rejection at these levels could trigger a retracement. The structure of the breakout indicates significant buyer interest, but consistent momentum is key for further gains.

Source: TradingView

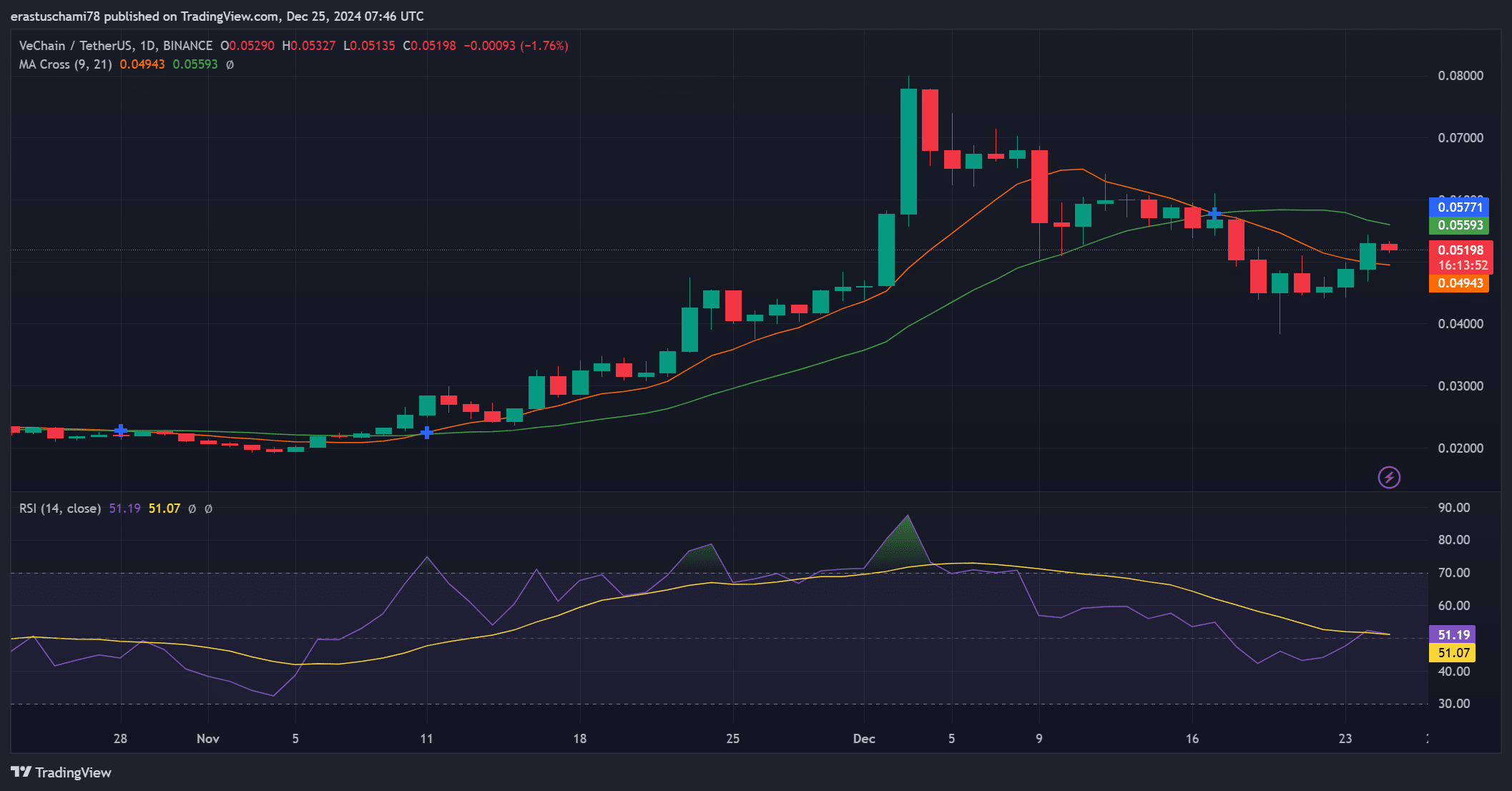

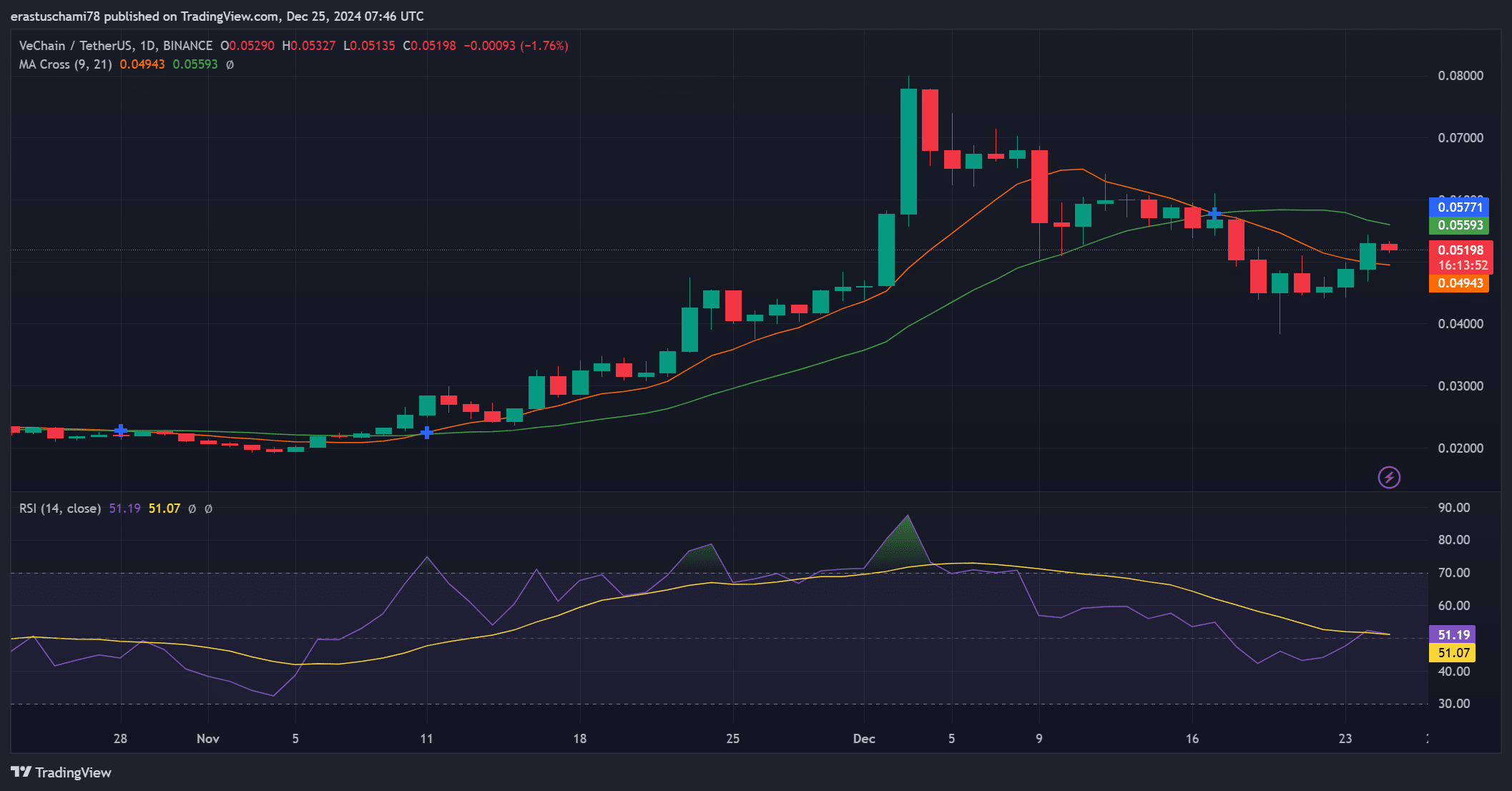

VeChain technical indicators: Signals of continued strength

Key technical indicators align with the bullish narrative. The RSI stands at 51.19, showing room for growth without entering overbought territory.

Additionally, the MA cross between the 9-day ($0.04943) and 21-day ($0.05593) moving averages highlights a positive trend, signaling potential for continued upward movement.

These indicators suggest that the breakout is backed by technical strength, with traders likely positioning for further gains.

Source: TradingView

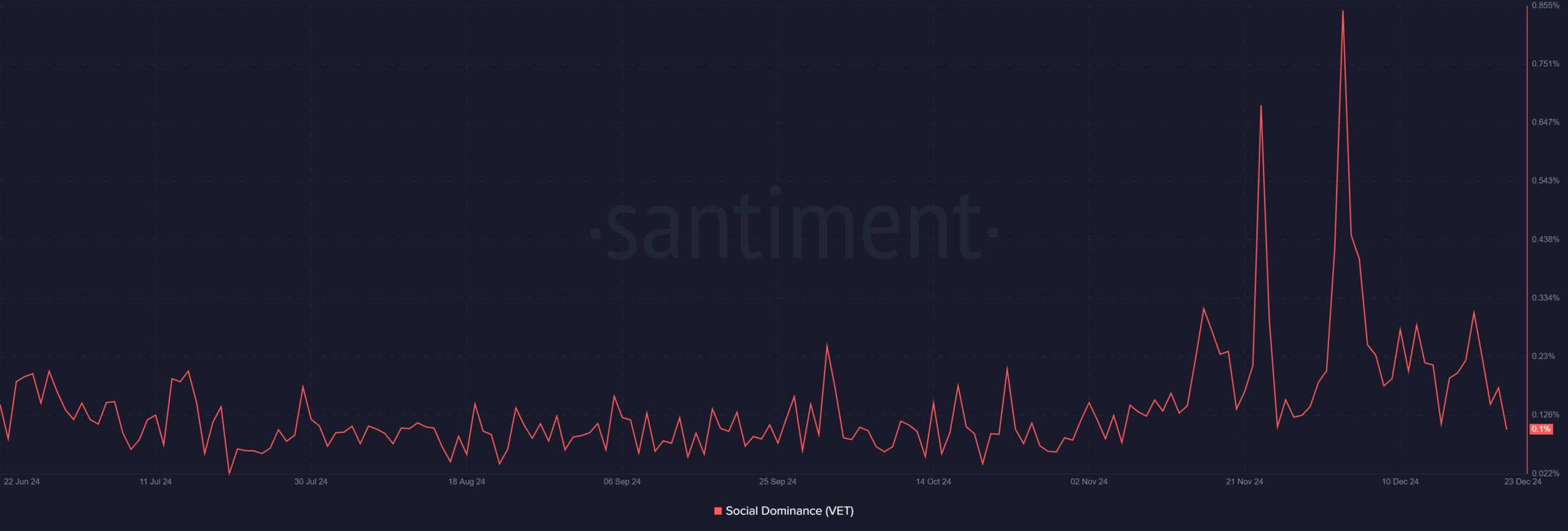

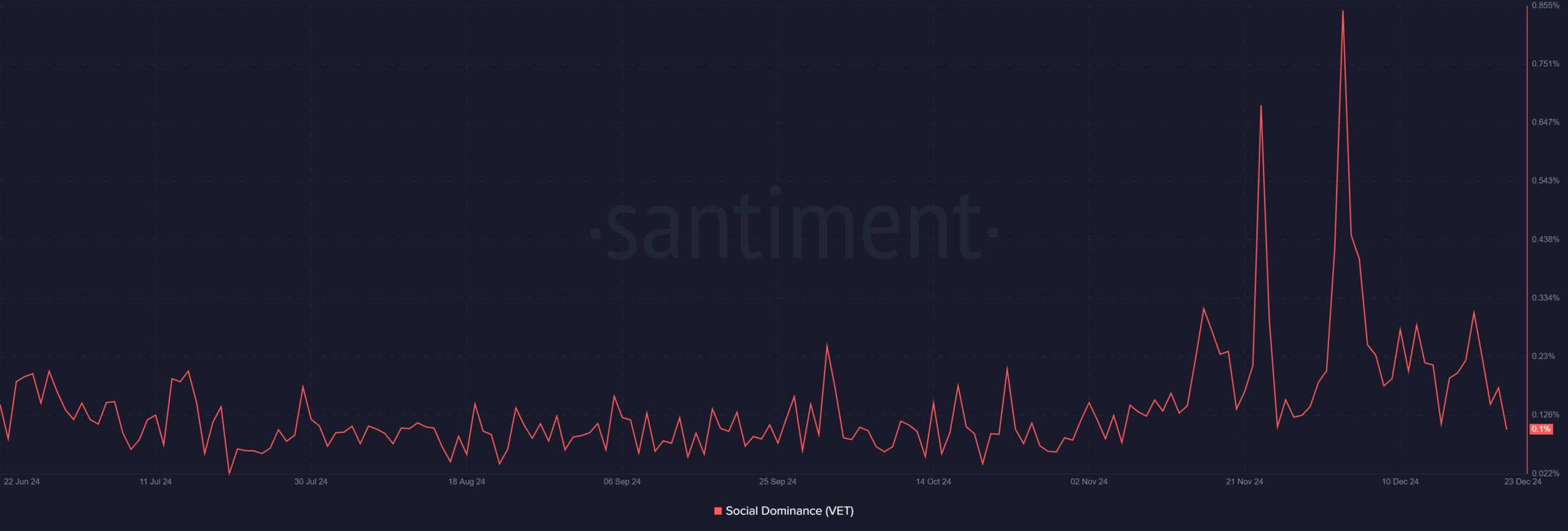

VET social dominance: A slight decline

Despite the price surge, VET’s social dominance has experienced a drop, declining to 0.1% from its recent peaks above 0.7%. This could reflect a temporary lag in social media attention compared to its price performance.

However, this divergence might also suggest that the breakout is driven by more significant market participants, rather than speculative retail activity, which could lend credibility to the move.

Source: Santiment

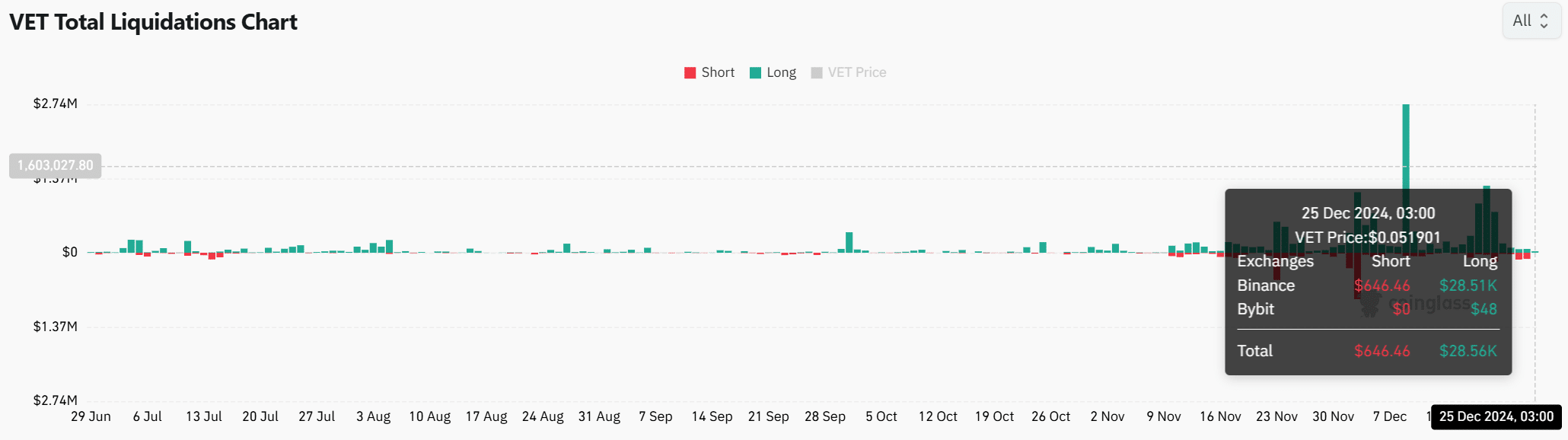

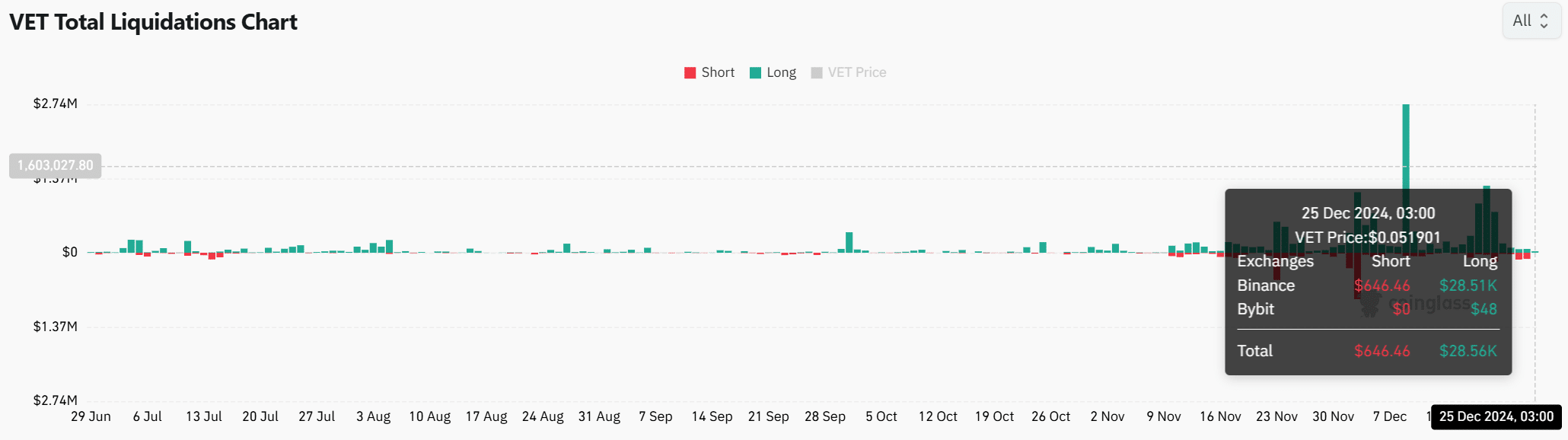

Open interest and liquidations: Rising confidence

Open interest has increased by 13.11%, reaching $88.23 million, reflecting renewed confidence among derivatives traders as per Coinglass analytics.

Total liquidations reveal $28.56K in long positions and $646.46 in short positions, indicating cautious optimism rather than excessive exuberance.

The balance between these metrics suggests a healthy market structure, supporting the potential for sustained growth.

Source: Coinglass

Read VeChain’s [VET] Price Prediction 2024-25

VeChain’s breakout from the bullish pennant pattern, supported by strong volume and technical indicators, signals a positive outlook.

With resistance near $0.057 and continued support from technical and market metrics, VET is well-positioned to maintain its upward trajectory in the short term.

Credit: Source link