The crypto market is down today, with the global cryptocurrency market capitalization falling by 1.0% to $3.74 trillion, according to data from CoinMarketCap. The 24-hour trading volume stands at $238 billion, reflecting a modest slowdown in market activity.

TLDR:

- 8 of the top 10 cryptocurrencies are down;

- BTC -0.8% ($107,735), ETH -1.5% ($3,831);

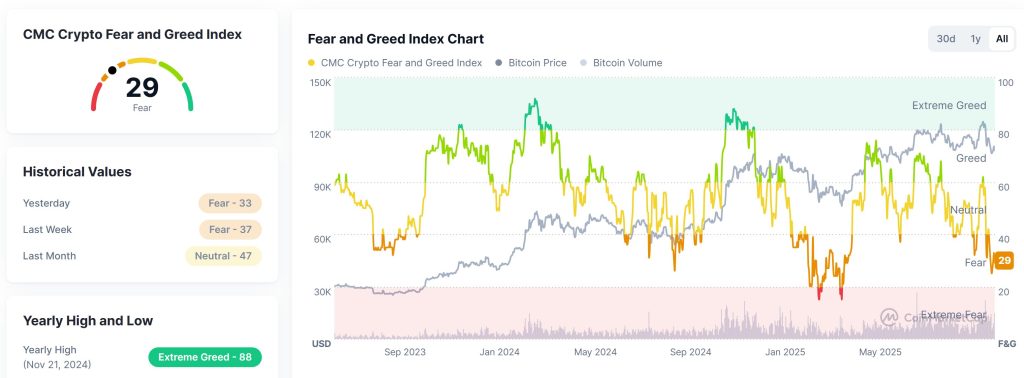

- Fear & Greed Index dropped to 29 (Fear);

- Bitcoin faces resistance at $110K–$112.8K and support around $106.6K;

- ETH is consolidating between $3,750–$4,250;

- Early Bitcoin whale Owen Gunden moved 364 BTC ($40.25M) to Kraken;

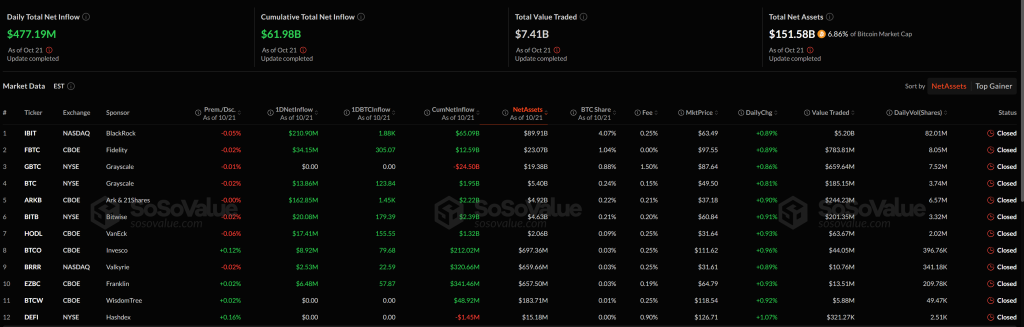

- US spot Bitcoin ETFs saw $477.19M in inflows;

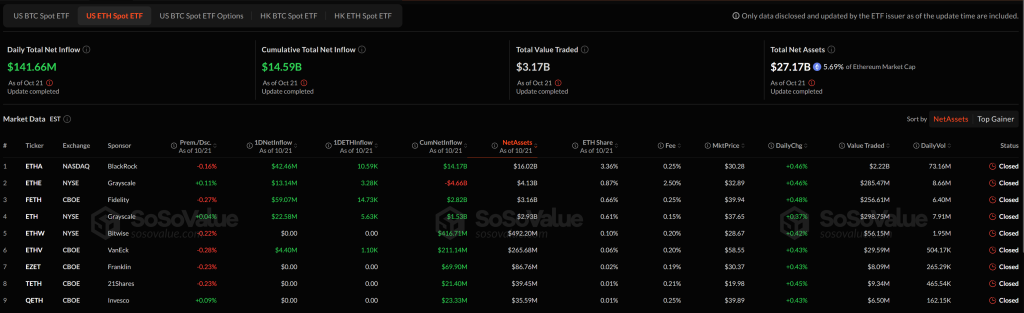

- US spot Ethereum ETFs recorded $141.66M inflows;

- Retail chain Bealls now accepts crypto payments across 660 US stores;

Crypto Winners & Losers

At the time of writing, 8 of the top 10 cryptocurrencies by market cap have traded lower in the past 24 hours, showing continued weakness across major assets.

Bitcoin (BTC) is down 0.8%, trading at $107,735, with a market cap of $2.14 trillion.

Ethereum (ETH) has dropped 1.5% over the same period to $3,831, while Binance Coin (BNB) declined 0.9% to $1,068.

Among other leading coins, Solana (SOL) slipped 0.7% to $184.92, and XRP (XRP) edged down 1.4% to $2.40.

The only notable gainer among top assets is Lido Staked Ether (stETH), up 1.0% in the last 24 hours, trading at $3,828.

Further down the list, Dogecoin (DOGE) lost 1.9% to $0.1909, while Cardano (ADA) declined 1.5% to $0.6358.

The day’s trending tokens include EVAA Protocol, up 4.0% to $7.39, Aster, down 0.3% to $0.099, and Hyperliquid, nearly flat at $35.93.

Meanwhile, MonbaseCoin topped the gainers’ chart with a 5.6% rise, followed by EVAA Protocol (+4.0%) and GeorgePlaysClashRoyale (+40.2%), marking standout performances amid an otherwise red market.

Meanwhile, early Bitcoin whale Owen Gunden has transferred 364 BTC, worth around $40.25 million, to crypto exchange Kraken today, according to on-chain data. Despite the sizable deposit, Gunden still holds an impressive 10,959 BTC, valued at approximately $1.19 billion.

US–India Trade Deal Could Reshape Global Capital Flows

The United States and India are reportedly close to finalizing a landmark trade agreement that would cut tariffs on Indian exports to the US from around 50% to 15%, marking a significant shift in global trade dynamics.

In exchange, India would gradually curb its imports of Russian oil and open its agricultural market to more US products. The deal could be announced between October 26–28 during the ASEAN Summit, where President Trump and Prime Minister Modi are expected to meet.

Analysts say the agreement could accelerate supply chain realignment across Asia, positioning India as a partial replacement for China’s manufacturing base.

In the crypto market, Bitcoin (BTC) faces dense liquidation zones near $111,000 with support around $106,600, according to CoinGlass data.

Analysts at Bitunix note that confirmation of the deal could trigger global capital repricing and temporarily dampen risk appetite in crypto. However, they add that longer-term de-dollarization trends and the rise of regional settlement systems may bolster structural demand for digital assets.

Levels & Events to Watch Next

At the time of writing on Wednesday, Bitcoin trades at $108,137, showing a slight intraday decline of 0.22%. The price briefly dropped to an intraday low near $107,500 after failing to hold above $109,000 earlier in the session. BTC has been moving sideways over the past few days as traders await fresh macro catalysts.

If Bitcoin breaks above the $110,000 resistance, it could trigger a move toward $112,800 and possibly $115,000, where stronger selling pressure may emerge.

Conversely, a drop below $107,000 could expose the $105,000 level, with a deeper correction potentially revisiting $102,000 support.

Meanwhile, Ethereum is trading around $3,849, down 0.64% in the last 24 hours. ETH has been consolidating within a wide range between $3,750 and $4,250 since early October, with declining volume suggesting reduced market participation.

If ETH manages to break above $3,950, the next resistance sits near $4,150, followed by $4,400. However, a breakdown below $3,800 could lead to further downside toward $3,650 and $3,500.

Meanwhile, the crypto market sentiment remains deep in the fear zone, with the Crypto Fear and Greed Index dropping to 29, signaling rising caution among traders. The index has fallen from 33 yesterday and 37 last week, marking a steady decline in investor confidence over recent days.

Compared to last month’s neutral reading of 47, sentiment has clearly weakened as market volatility and profit-taking dominate trading behavior. This represents one of the lowest fear levels since early 2025, reflecting investors’ growing uncertainty following Bitcoin’s recent pullback below $110,000.

The US spot Bitcoin ETFs saw a strong rebound in inflows on October 21, recording a total daily net inflow of $477.19 million, according to SoSoValue data.

BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows with $210.9 million, followed by Ark 21Shares (ARKB) with $162.85 million, and Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $34.15 million. Other ETFs seeing positive flows include Bitwise (BITB) with $20.08 million and VanEck’s HODL with $17.41 million.

The US spot Ethereum ETFs also saw a total daily net inflow of $141.66 million on October 21, according to SoSoValue data.

Among the nine listed ETFs, Fidelity’s FETH led the day with $59.07 million in inflows, followed by BlackRock’s ETHA with $42.46 million, and Grayscale’s ETHE with $13.14 million. Grayscale’s ETH fund also recorded a healthy $22.58 million inflow, showing renewed investor interest after weeks of outflows.

Meanwhile, a century-old US retail corporation, Bealls, is starting to accept crypto payments through a partnership with Flexa across its 660 stores in 22 states.

Credit: Source link