- FTM’s MACD, RSI, and on-chain indicators showed bullish momentum, signaling potential for more gains.

- Rising volume, Open Interest, and large transactions highlight strong support for FTM’s rally.

Fantom [FTM] has made a notable breakout from its descending channel, trading at $0.6721 with a 3.15% increase at press time.

This surge, combined with a 56.79% spike in 24-hour trading volume, has grabbed attention in the crypto market.

As traders eye potential all-time highs, the question remains: can FTM sustain this momentum and capitalize on its breakout?

Moving averages and key levels to watch

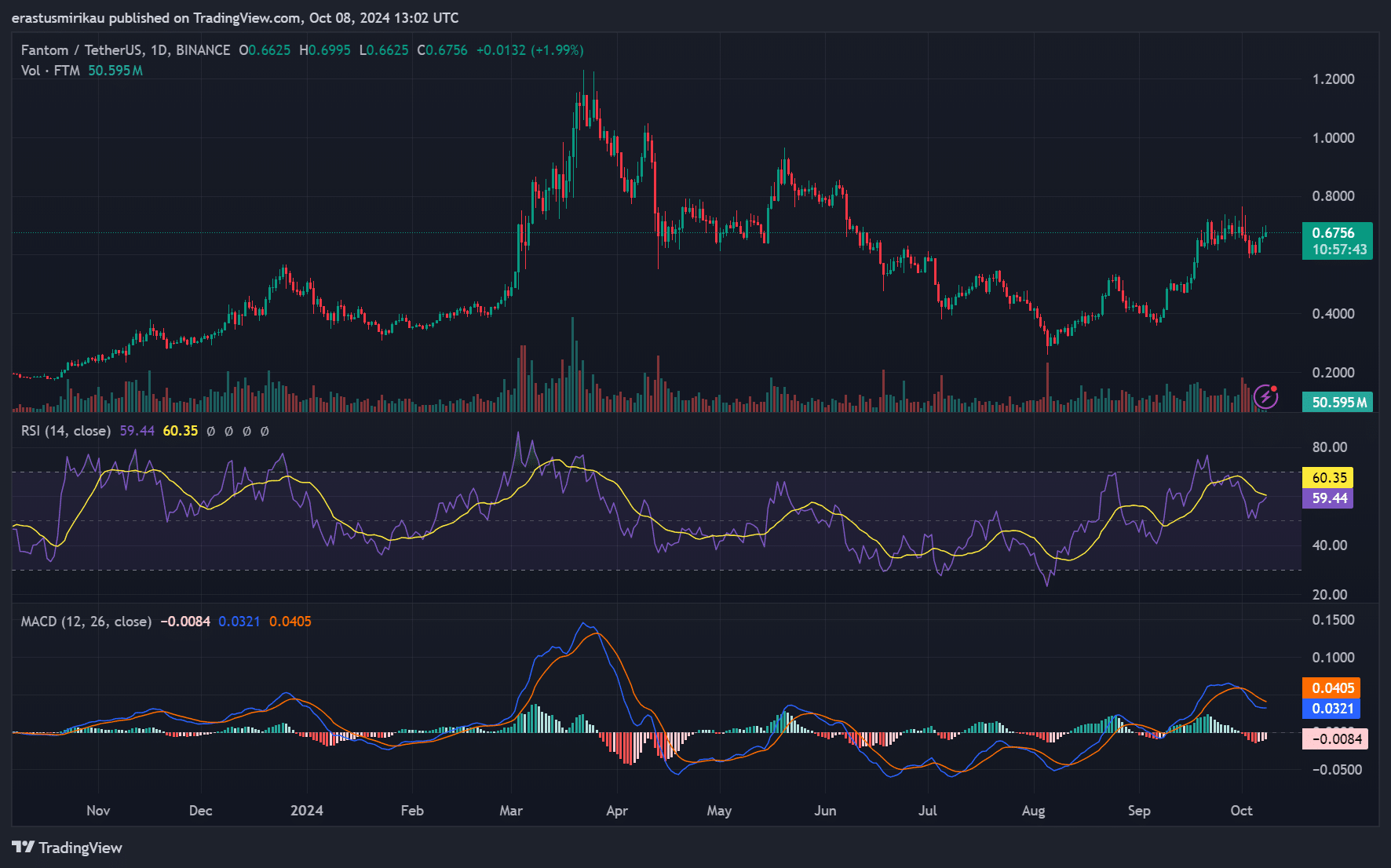

FTM’s technical indicators offered a promising outlook for its recent price movement. The RSI was at 60.35 at press time, indicating increasing buying pressure.

However, it still leaves room before the market enters overbought territory (above 70), suggesting the possibility of further upward movement.

Additionally, the MACD also confirms growing bullish momentum. The MACD line stands at 0.0405, having crossed above the signal line at 0.0321.

This bullish crossover signals an acceleration in upward momentum, further reinforcing the potential for price gains.

Therefore, the convergence of these two indicators suggested that FTM may continue to rise in the near term, as long as the momentum holds.

Source: TradingView

FTM on-chain metrics: What do they reveal?

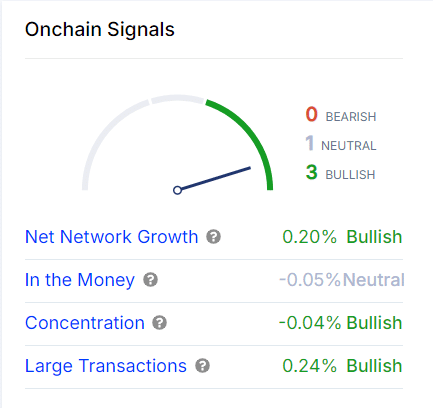

FTM’s on-chain indicators are signaling strength. Net network growth has increased by 0.20%, showing steady adoption, while concentration metrics indicate that large holders, or whales, are maintaining their positions.

Large transactions have also increased by 0.24%, indicating growing interest from institutional players.

However, “In the Money” metrics remain neutral, suggesting that not all investors are currently in profit. Despite this, the overall on-chain data suggests FTM is in a strong position for further growth.

Source: IntoTheBlock

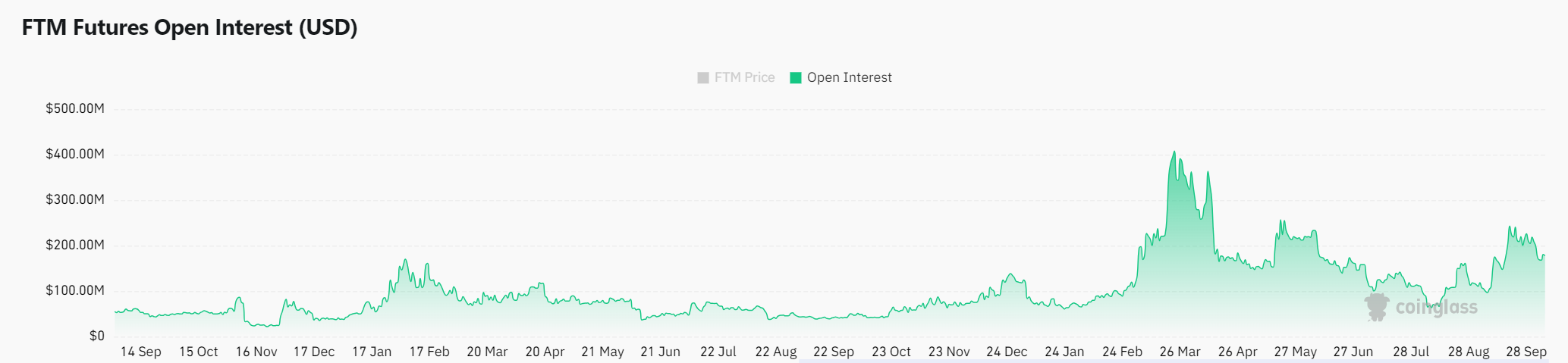

Volume and Open Interest: Fuel for the rally?

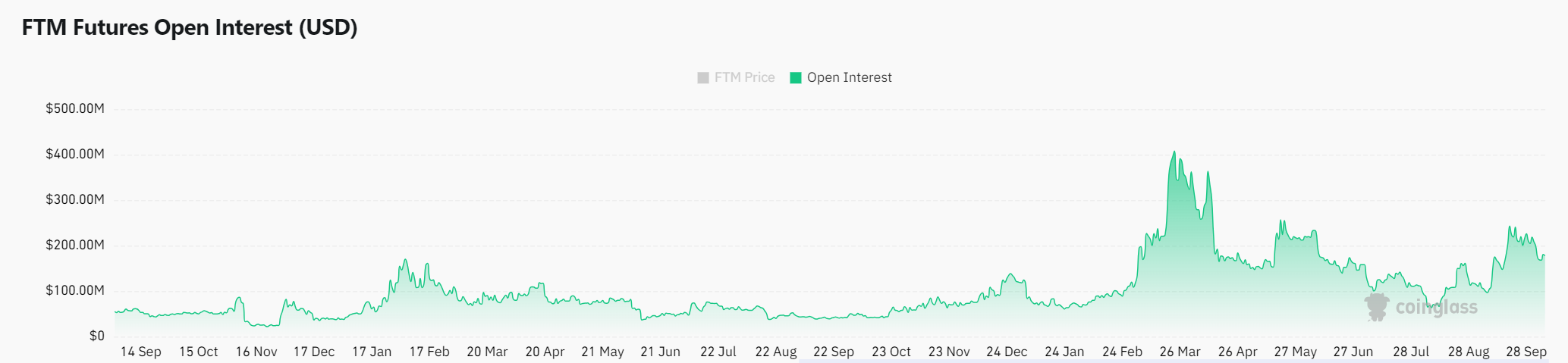

FTM’s trading volume has risen by 42.25% in the past 24 hours at press time, reaching $804.65 million, a significant indicator of market interest, according to Coinglass.

Open Interest in Futures contracts has also jumped by 7.57%, reflecting growing confidence among traders. So, the market believes that FTM has room to grow.

Source: Coinglass

Read Fantom’s [FTM] Price Prediction 2024-25

Will FTM reach new highs?

Given FTM’s technical breakout, positive on-chain metrics, and rising trading volume, it seems well-positioned for further gains.

Therefore, FTM is likely to test new highs soon, provided it breaks key resistance at $0.720 while maintaining robust support levels.

Credit: Source link