- MEW has a strongly bullish outlook for the coming days

- A Bitcoin correction below $63.3k will shift sentiment bearishly

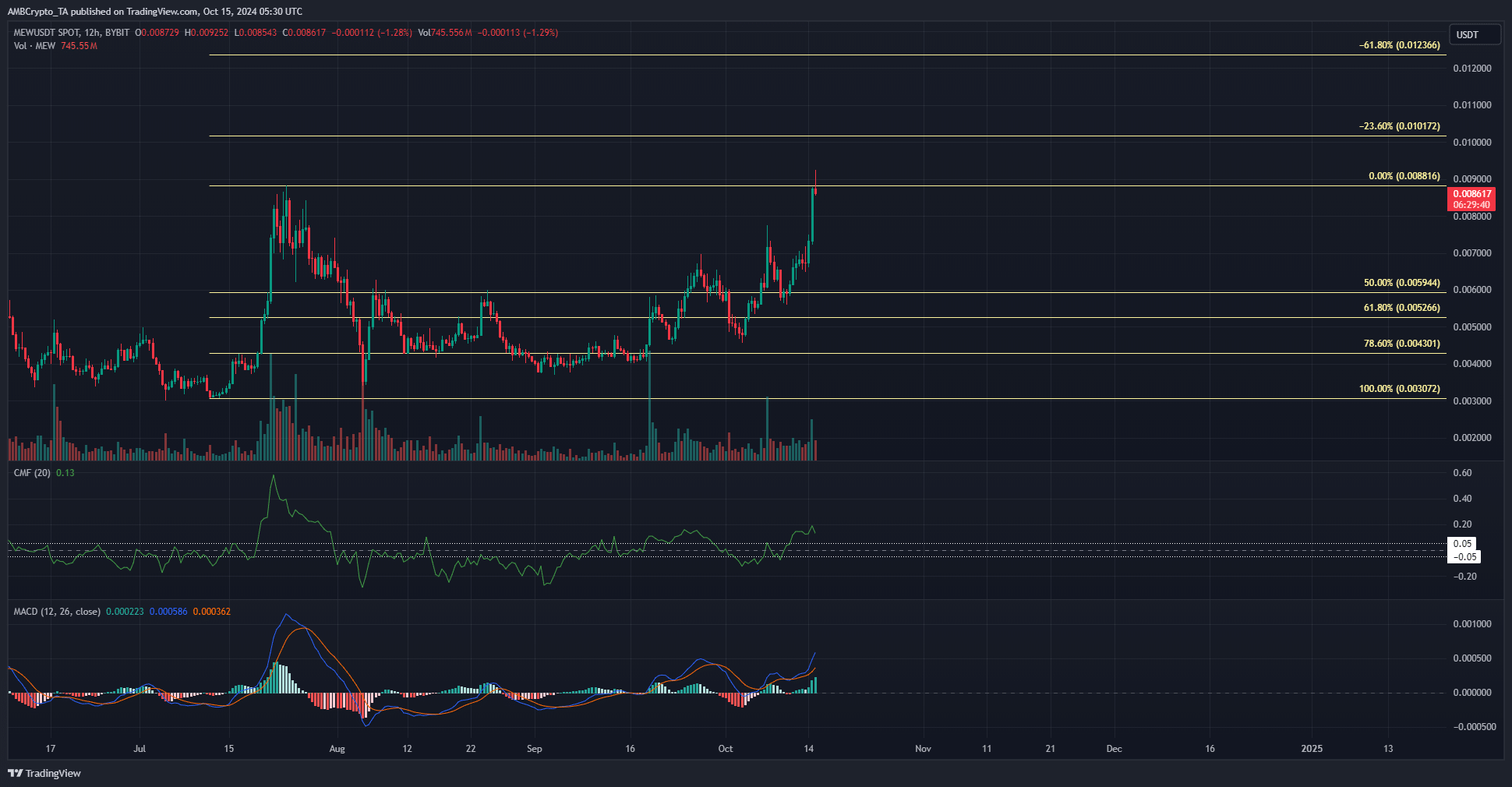

cat in a dogs world [MEW] was trading at the highs it set during the rally in the second half of July. The market structure has been bullish since the 19th of September. The buying pressure showed bulls were dominant in the past week.

There is a chance of a Bitcoin [BTC] rejection from the $66k resistance zone. With the memecoin up by 86% in October, traders would do better to take profits than enter long positions at a resistance level.

MEW expectations amid bullish meme coin market

Source: MEW/USDT on TradingView

The recent price rally of BTC has been accompanied by a soaring meme coin and AI sector. MEW belongs to one of the leading sectors in terms of performance, which fuels the continued bullish conviction behind the token.

However, some caution is warranted. The price has not yet breached the highs from July. Once it does, traders and investors can look for a retest of $0.0088 to buy.

To the north, the next targets will be the Fibonacci extension levels at $0.1 and $0.123. Until such a breakout occurs on high trading volume, market participants must expect a sizeable pullback.

The 12-hour RSI showed momentum favored the buyers. The CMF’s reading of +0.12 indicated heavy capital inflow and high demand.

Short-term warning signs

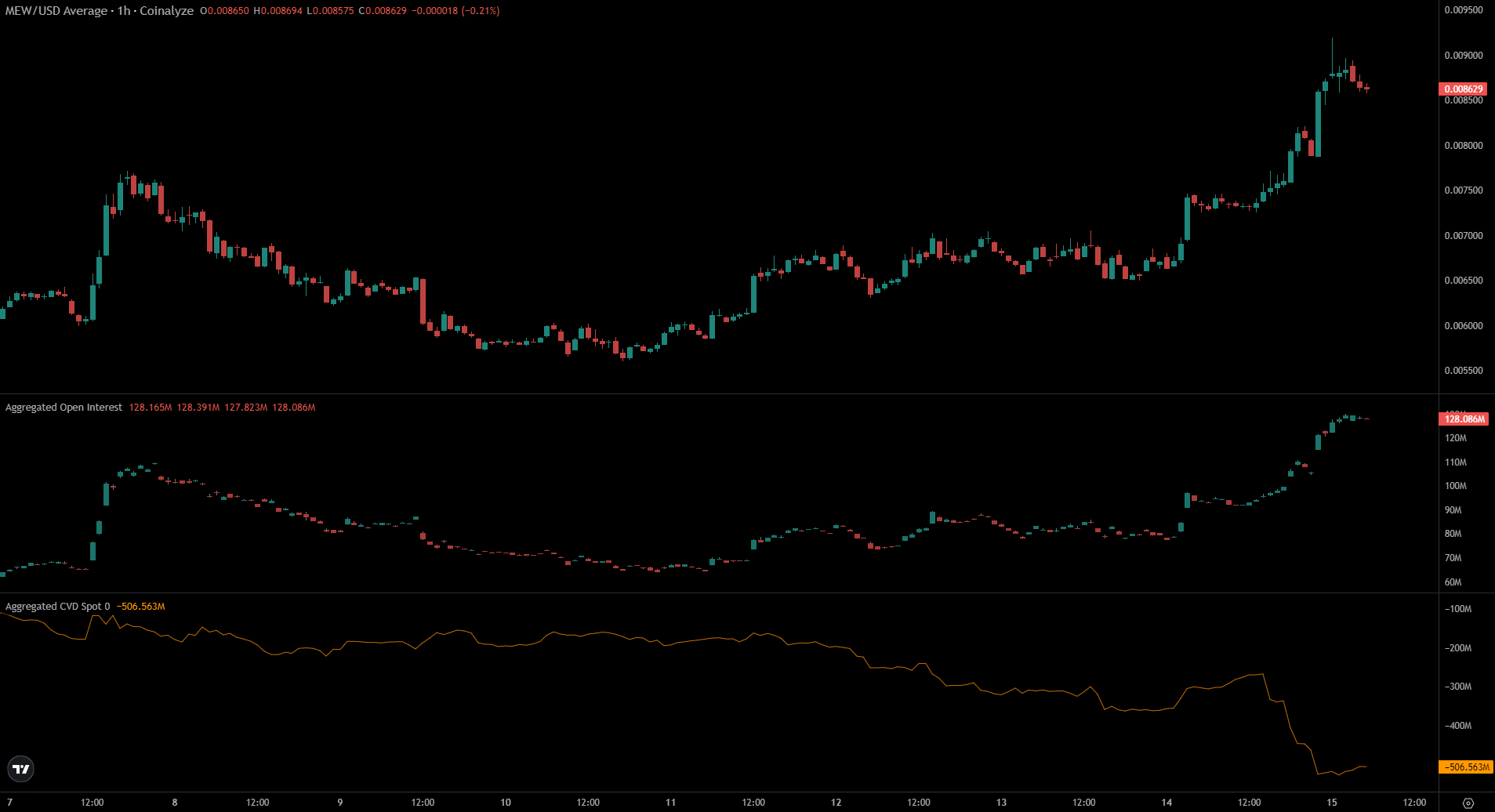

Source: Coinalyze

The spot CVD on the 1-hour chart showed selling pressure began to increase in recent hours. This disagreed with the bullish findings from the CMF. It was a sign of profit-taking activity near the three-month highs.

Realistic or not, here’s MEW’s market cap in BTC’s terms

Meanwhile, the Open Interest and prices trended higher and speculators seemed bullishly poised. It is unclear where MEW could go in the coming hours.

AMBCrypto expects a minor dip to $0.0767, a lower timeframe support level, before a breakout, provided Bitcoin does not face large losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Credit: Source link