- Solana retested a key pennant support at press time.

- Metrics and a rising TVL indicated growing ecosystem strength.

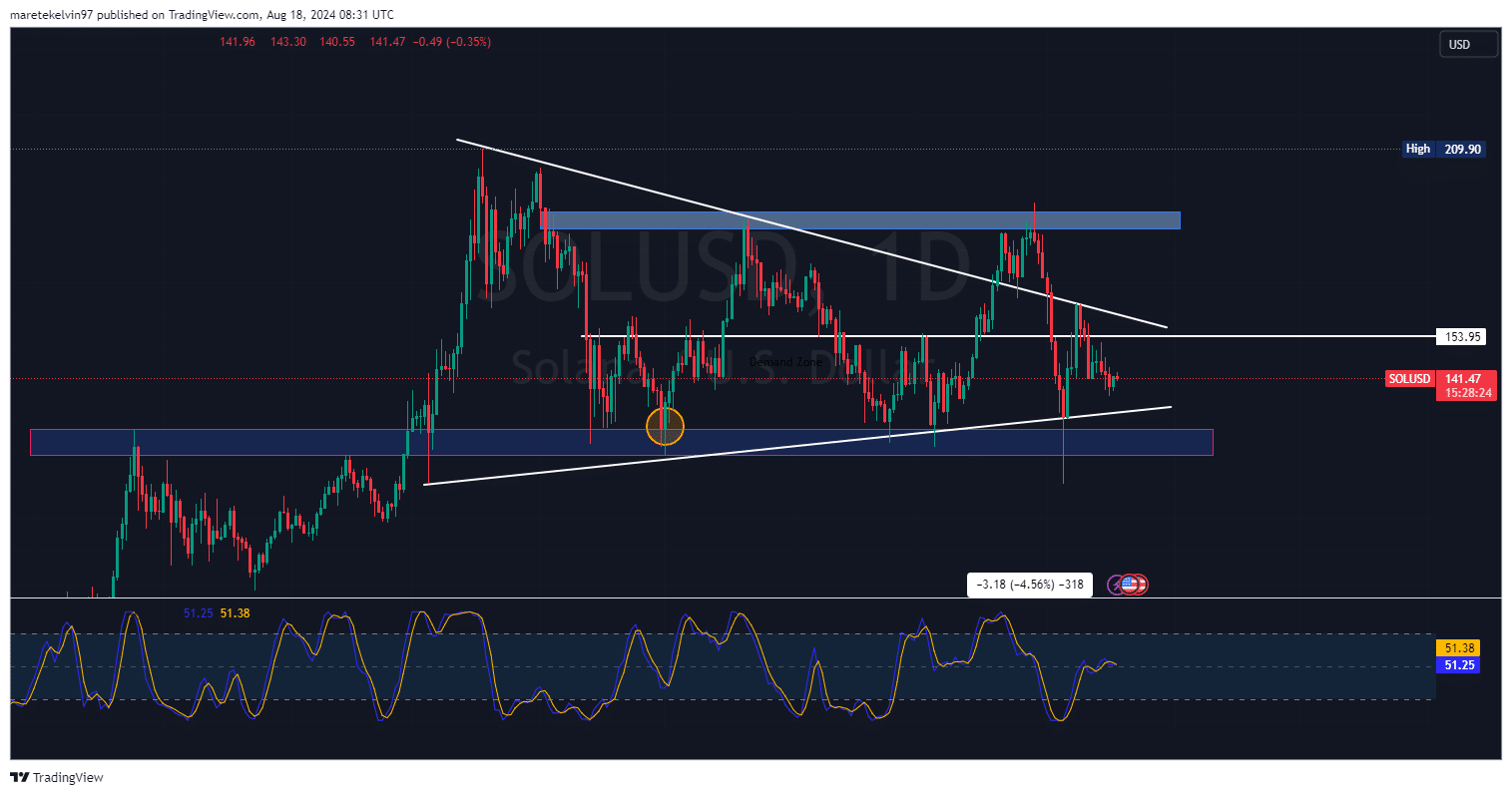

Solana [SOL] is showing signs of a possible bullish breakout after a successful test of key support. The altcoin has been consolidating within a bullish pennant pattern in the past five months.

Over the last 24 hours, SOL bounced off the bottom line of the pennant pattern, indicating increased buying pressure at this support level.

This key support could act as a launch pad for a potential bullish rally to the next resistance level at around $153.

The $153 resistance level is significant for SOL bulls. A clear breach above this level can lead to a resurgence in buying pressure and pave the way for the retesting of prior peaks.

Source: TradingView

Reduced selling pressure fuels bulls

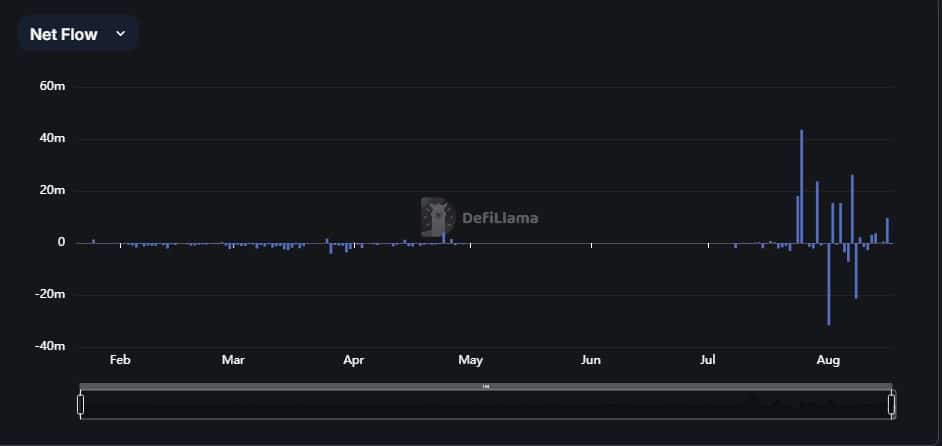

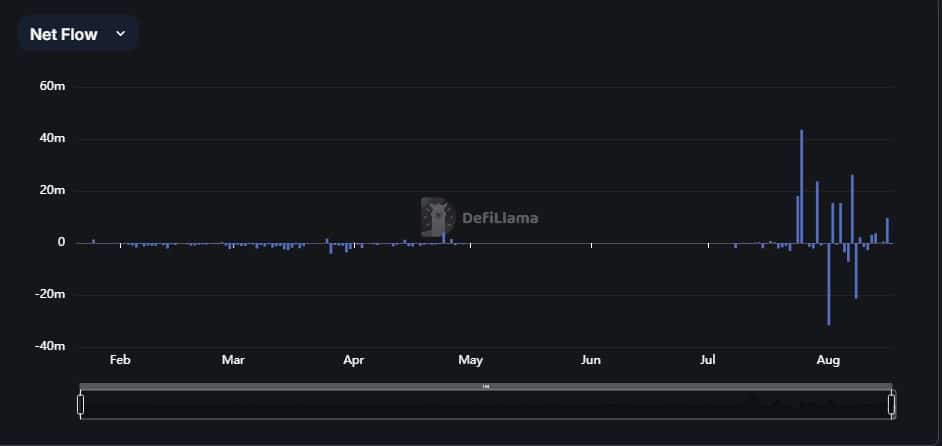

Adding to the aforementioned price action, DeFiLlama’s Net Flow data indicated that sellers have reduced significantly in the last 24 hours.

Accordingly, Net Flow went down from 9.58 million to -0.32 million at press time, suggesting lesser selling pressure.

Source: DeFiLlama

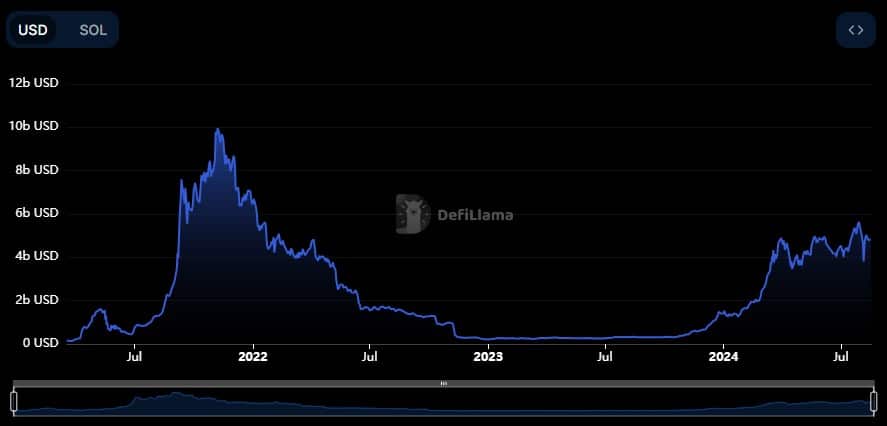

SOL DeFi flexes its muscles

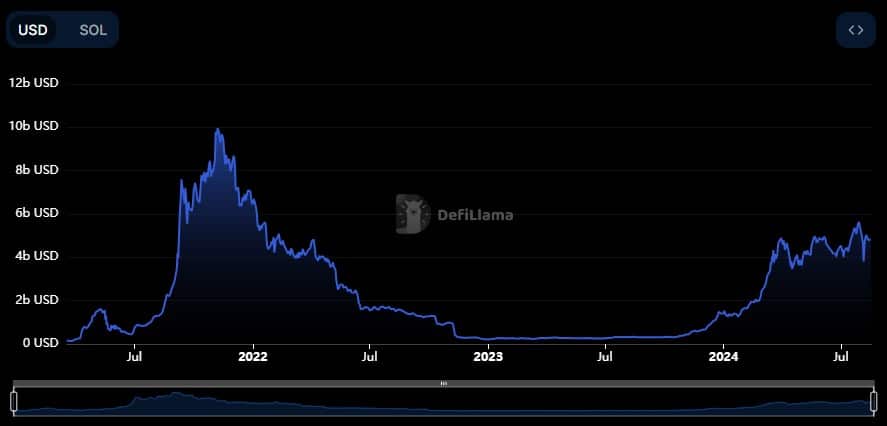

In addition to the reduced net flow, Solana’s Total Value Locked (TVL) has been on an increasing trajectory, indicating growing confidence in the DeFi ecosystem among network users.

The growth implied additional funds being deposited into protocols based on Solana, which is a positive indicator of network adoption.

Source: DefiLlama

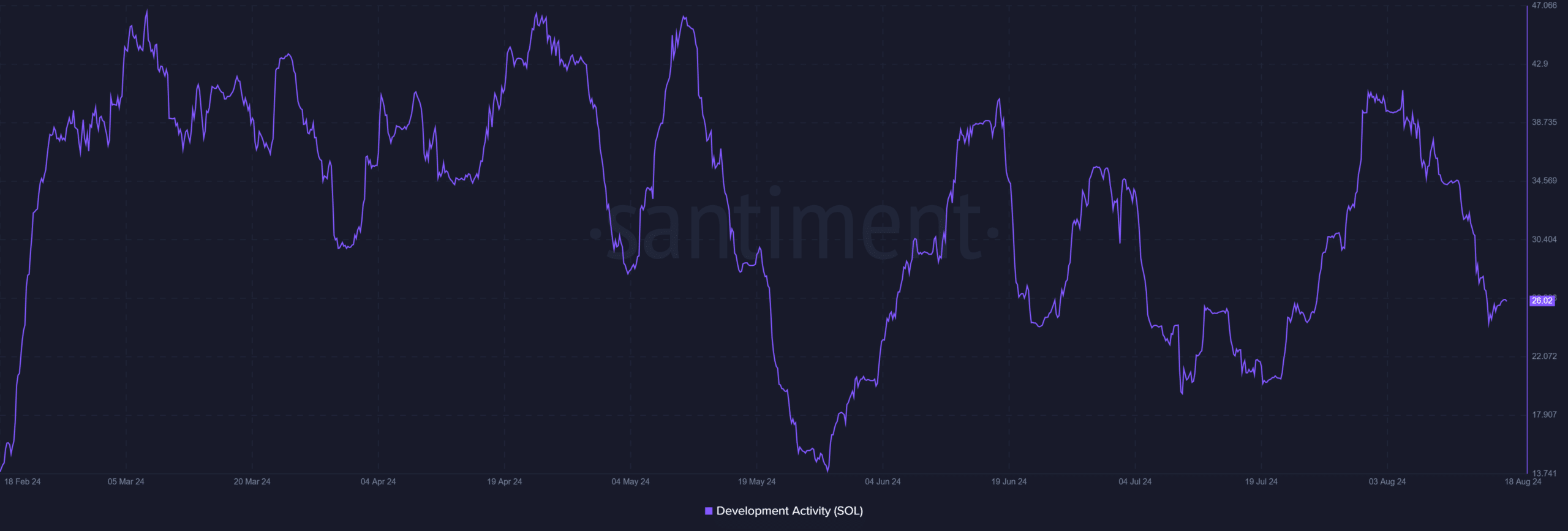

Moreover, development activities directed towards improving the Solana network have escalated within recent weeks, according to Santiment data.

Historically, this surge in development activity has caused a major price rally. This is a positive signal for the Solana bulls.

Source: Santiment

Read Solana’s [SOL] Price Prediction 2024-25

Concurrently, Social Volume indicated an overall gradual increase. This growing social attention often results in increased trading activity and price movements.

Source: Santiment

The confluence of SOL’s technical and on-chain metrics all painted a bullish picture. If Solana breaks above the bullish resistance level, further price rallies may be witnessed.

Credit: Source link