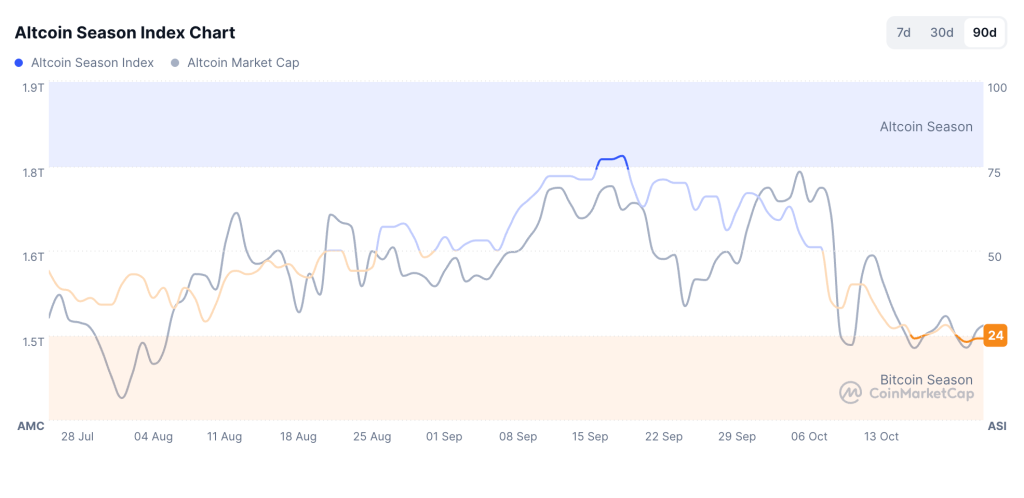

Altcoin Season Index sits near 24, which indicates thin breadth and a market still led by Bitcoin trends. Even with green prints in select names, allocation remains selective and event-driven.

Today’s market centers on a policy headline and two tokens that benefited from active venues rather than a broad risk reset.

Investors are weighing whether a friendlier policy tone can change the near-term path for altcoins or if this is another brief pop inside a cautious October. The answer depends on participation, not headlines alone.

WLFI: Policy Shock Pulls Inflows

WLFI is currently trading near $0.14, up by 11% in 24 hours, with trading volume up about 210%. The move tracks reports that President Trump issued a pardon to Binance co-founder Changpeng Zhao, also known as CZ.

Markets read the decision as a positive for the industry, reducing perceived policy risk and improving the odds of friendlier enforcement.

WLFI’s next phase depends on whether current enthusiasm transitions into steady participation. A healthier pattern would show funding rates returning toward neutral while open interest and spot volume expand together, suggesting that buyers are engaging across positions rather than chasing momentum.

Trading distribution across multiple venues would also hint at broader confidence, whereas a quick return to one-sided flow on a single exchange often precedes price retracement once the headline impulse fades.

Morpho: Lending Activity Supports Steady Gain

Morpho is trading around $2.0, up 8% on the day. Consistent usage is reported across lending routes and vault strategies, with borrow and supply improving week over week.

Morpho Price (Source: CoinMarketCap)

Depth looked workable on major pairs, and spreads tightened compared with last week, which helped spot prints hold above reclaimed intraday levels.

For a lending token in a risk-light market, the watch items are utilization, deposits, and whether the price can stay above nearby support while volumes remain balanced. A sustained base keeps Morpho in rotation lists even if the index remains subdued.

SPX6900: Meme Liquidity Returns During Relief

SPX6900 is trading near $1.0, up by 7% in 24 hours. Meme baskets tend to catch flow when traders seek liquid, high-turnover pairs during relief windows. Data shows two-way participation with intraday bands narrowing into the close, a pattern that favors range extension attempts if volume persists.

Traders are watching the $1.05 to $1.10 zone for confirmation. A push through that band on rising volume would validate continuation. A slip back under $1.00 would imply the move was flow-driven and short-lived.

What Market Are We Looking At

The Altcoin Season Index at 24 still indicates comparatively narrow participation. That puts the burden on follow-through rather than first prints.

Altcoin Season Index (Source: CoinMarketCap)

A single policy event can brighten sentiment, but sustained improvement usually requires additional steps such as clearer compliance guidance, stable funding conditions, and deeper books across multiple venues.

Recent session lows and volume-weighted averages serve as more reliable context for positioning than isolated price spikes. Depth and spread consistency across venues often reveal whether participation is genuine or driven by transient flow.

WLFI’s tone will hinge on how funding levels and trading distribution evolve in the coming days, while Morpho’s stability rests on sustained utilization and deposit strength paired with price retention above recent support. SPX6900, by contrast, depends on whether its current upper trading band converts into a base supported by firm turnover.

If these structural signs improve while the altcoin index lifts from the low twenties, the market could transition from isolated momentum trades to a broader, more coordinated advance. Should they remain weak, rotation is likely to stay narrow and episodic, with brief rallies tied to immediate catalysts rather than enduring conviction.

Credit: Source link