- JPMorgan predicts XRP and SOL ETFs could attract $3-8 billion in net assets upon regulatory approval.

- XRP and SOL ETFs may follow successful adoption patterns seen with Bitcoin and Ethereum ETFs, according to JPMorgan.

JPMorgan’s recent analysis highlighted the potential impact of proposed exchange-traded funds (ETFs) on Solana (SOL) and XRP, anticipating considerable inflows if allowed.

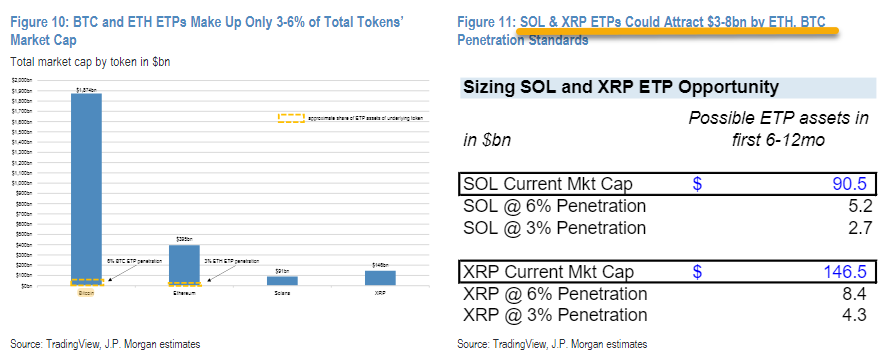

While XRP ETFs might see even more numbers, ranging from $4 billion to $8 billion in their first year, the analysis indicates SOL ETFs might draw between $3 billion and $6 billion in net new assets.

XRP and Solana ETFs May Mirror Bitcoin, Ethereum Success

The forecasts align with past trends whereby, in their first year, Bitcoin ETFs acquired around $108 billion in assets, accounting for about 6% of the market value of Bitcoin. In 6 months of their introduction, Ethereum ETFs also managed to collect around $12 billion, roughly 3% of Ethereum’s total market value.

Should these acceptance rates reflect one another, Solana and XRP ETFs may take front stage in the crypto market, therefore fostering further institutional involvement.

Already evident are market reactions that mirror report-based optimism. Solana’s price climbed around 2% to $185.81; more trading volume suggests more investor interest.

[mcrypto id=”126000″]XRP matched, rising over 2% to $2.53 and seeing matching increases in trading activity. This implies that investors are keenly observing changes in regulations and are hopeful about the acceptance of these cryptos.

[mcrypto id=”345586″]Still, clearance of the U.S. Securities and Exchange Commission (SEC) is absolutely crucial. Applications for SOL and XRP ETFs have been sent by several asset managers; the SEC is likely to analyze these files in the next months.

Although there is great hope, real results depend on different market and legal environments, which could affect this ETF’s performance.

With over $35 billion in cumulative inflows and 1.13 million BTC in assets under management, CNF noted previously that the U.S. Spot Bitcoin ETFs celebrated their one-year anniversary with remarkable performance.

With assets of $37.85 billion, BlackRock led the group; Fidelity came second at $12.14 billion. Other issuers who crossed the $2 billion mark, including Ark and Bitwise, also showed noteworthy increases.

Recommended for you:

Credit: Source link