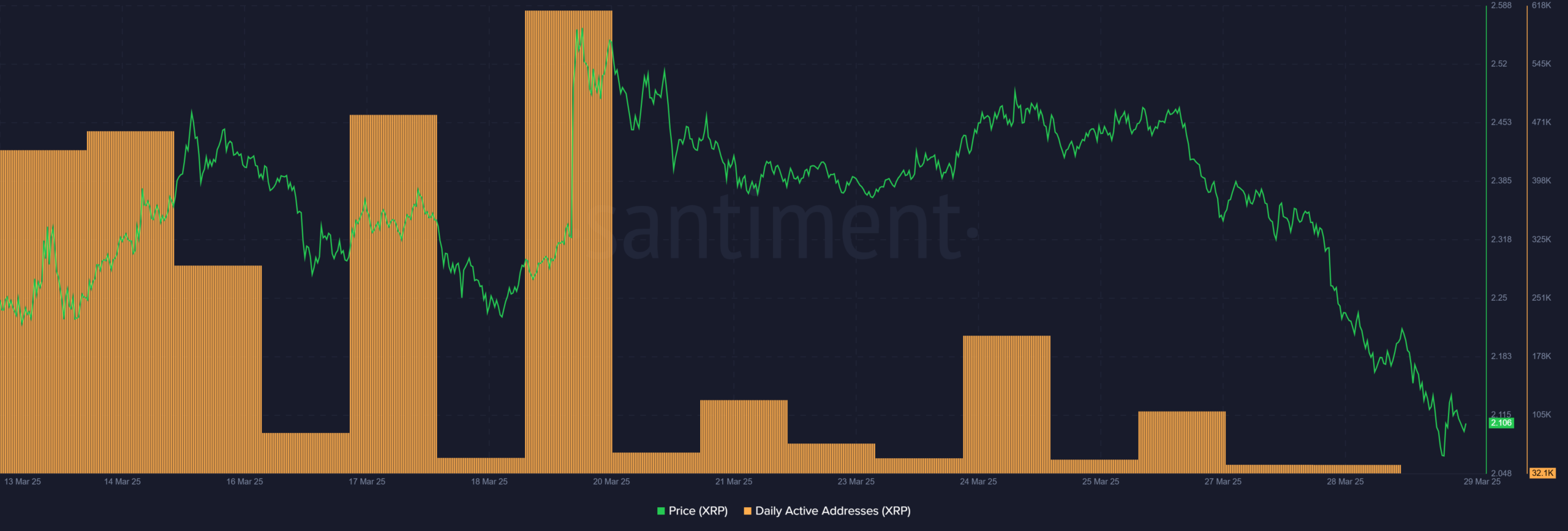

- Despite legal clarity, XRP faces market struggles with falling activity and price declines.

- XRP’s bearish momentum persists, as weak buying pressure and declining addresses signal cautious sentiment.

Ripple may have won the courtroom battle, but XRP is losing ground in the market. The SEC dropping its appeal should have been a game-changer, cementing XRP’s non-security status.

Instead, active addresses have plummeted nearly 70%, and the token’s price has slumped 11% in just a week.

Maybe clarity doesn’t always mean victory.

A legal victory with “ripple” effects

The U.S. SEC has dropped its appeal in the Ripple case, marking a pivotal moment for the crypto industry.

After years of legal wrangling, the decision not to challenge the 2023 ruling by U.S. District Judge Analisa Torres brings long-awaited clarity to XRP’s regulatory status.

The ruling confirmed that Ripple’s programmatic sales of XRP via secondary exchanges like Coinbase and Kraken did not violate securities laws, though direct sales to institutional investors were deemed securities violations, costing Ripple $125 million.

Experts have emphasized the significance of the SEC’s decision, as the Ripple case had progressed further than other dropped cases, such as those against Coinbase and Kraken.

With the legal dust settling, the focus now shifts to the possibility of an XRP ETF, with market optimism growing around potential approval in 2025.

But all is not what it seems.

Credit: Source link