- XRP faced bearish sentiment as the critical $2.73 resistance remained unbroken, frustrating traders.

- Futures Open Interest plunged $1 billion, exposing skepticism over XRP’s near-term recovery prospects.

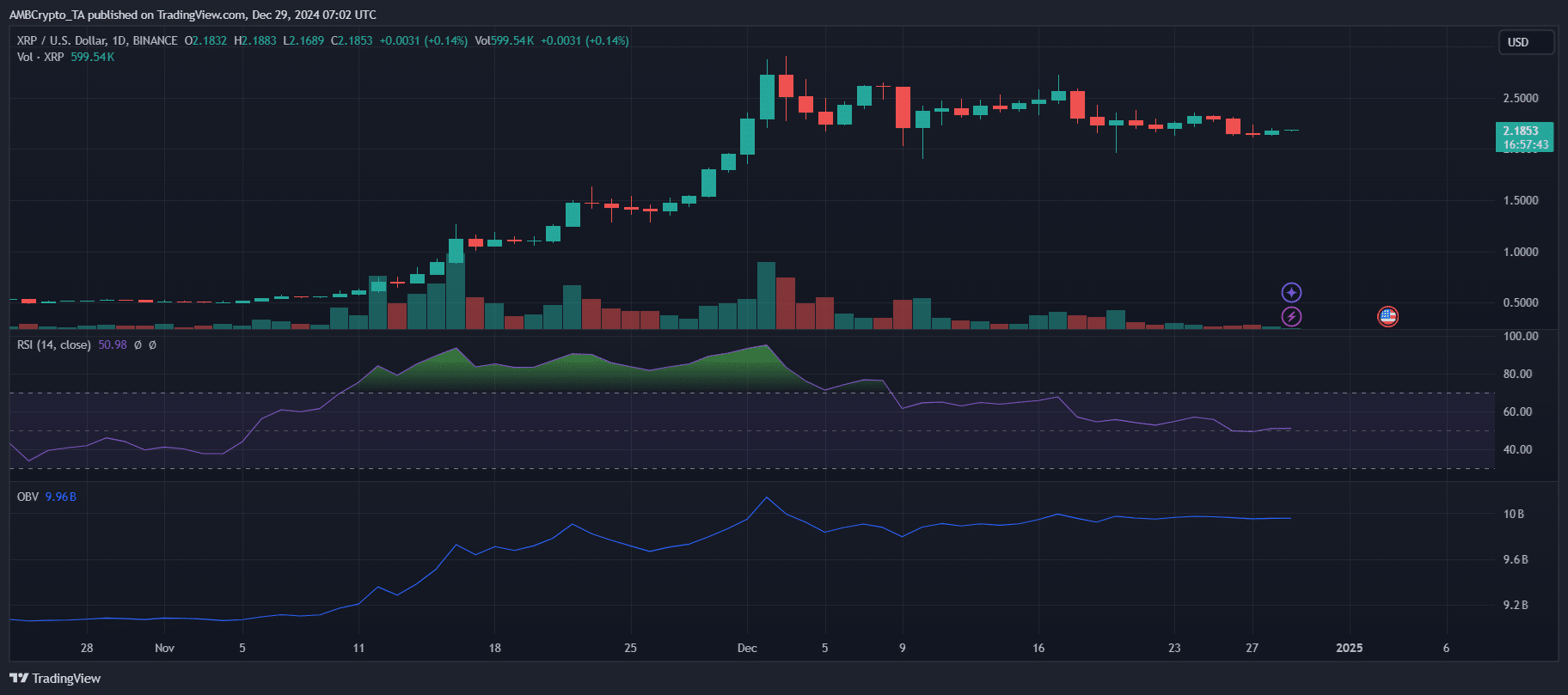

XRP has been locked in a prolonged consolidation phase, hovering below critical resistance levels for over a month, with no signs of a breakout.

This lack of upward momentum has frustrated traders and eroded market confidence.

Recent data paints a bleak picture: In the last 48 hours, XRP Futures Open Interest has nosedived by over $1 billion, highlighting a sharp decline in investor conviction. What’s driving this dramatic shift in sentiment?

XRP Futures OI sheds $1 billion

Source: Coinglass

XRP: Critical investor uncertainty?

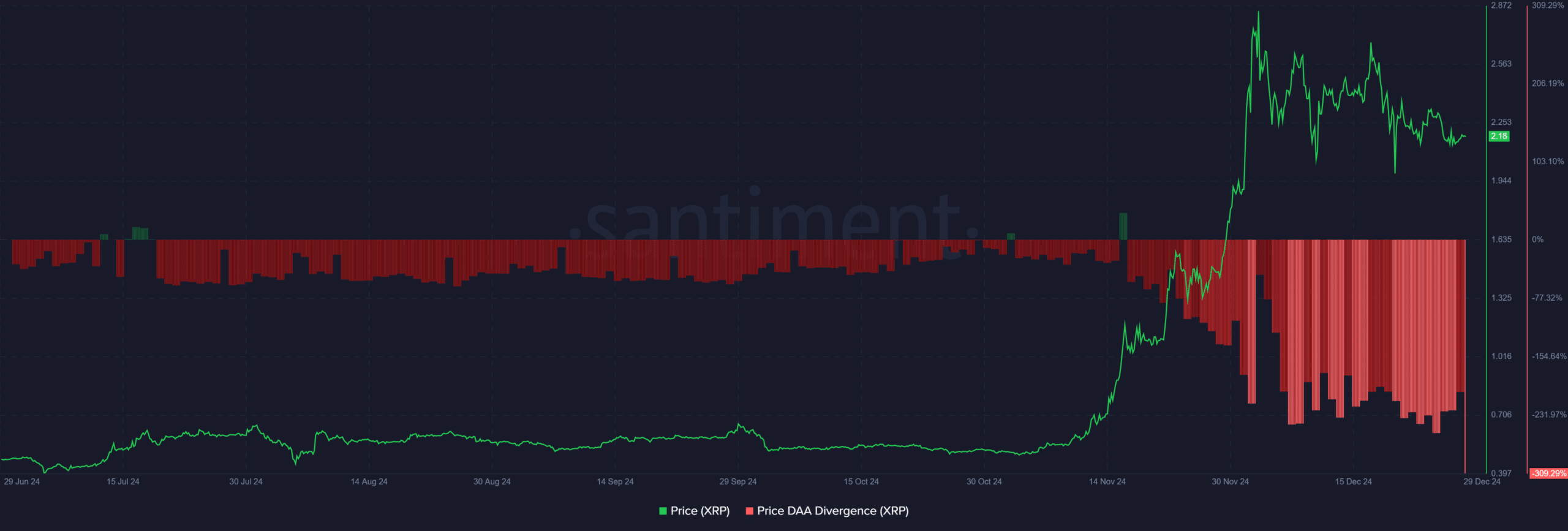

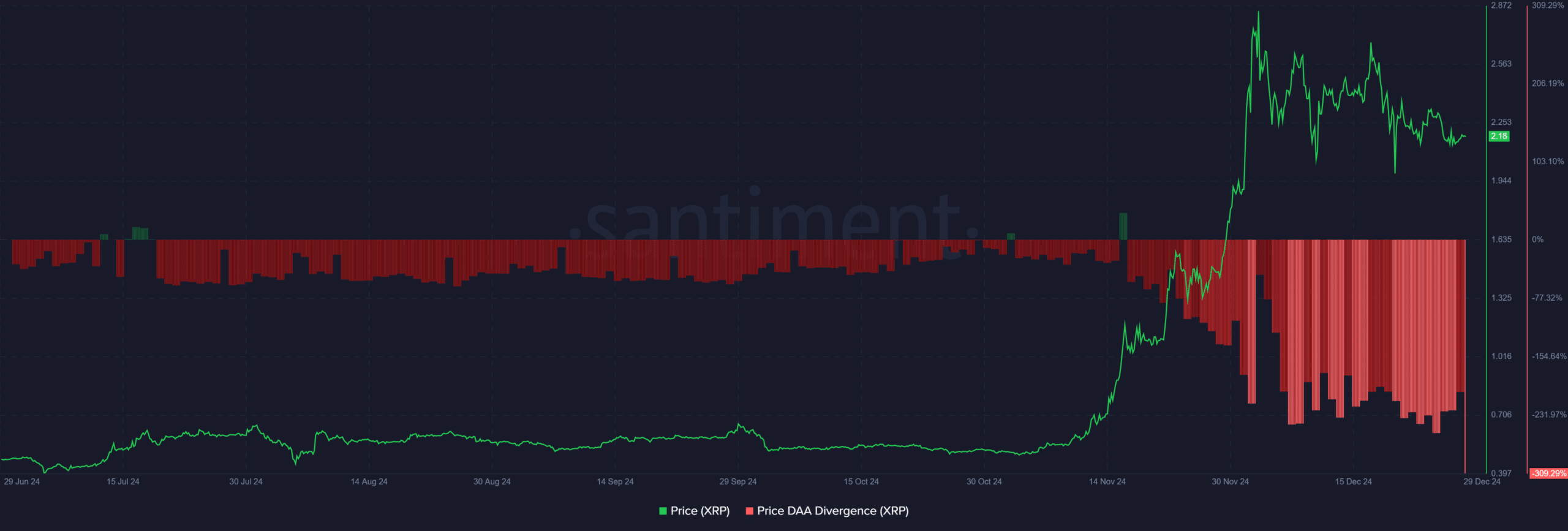

The XRP Price DAA Divergence chart highlighted a critical mismatch between price performance and network activity.

As XRP’s price surged in late November, DAA divergence turned sharply negative, signaling that network engagement failed to scale alongside the rally.

This divergence suggests the price movement was driven more by speculative trading rather than organic network growth or utility adoption.

Source: Santiment

In the aftermath of the rally, DAA divergence remained in negative territory, reflecting persistent skepticism among on-chain participants.

Without an uptick in active addresses, the price’s ability to sustain momentum may be in jeopardy.

The absence of strong on-chain activity — despite the recent surge — raises concerns about the sustainability of any near-term recovery and could keep XRP locked in a consolidated or downward trend unless network fundamentals improve.

Key levels to watch

Credit: Source link