- The daily market structure and momentum were bearish.

- A 6-12% price bounce could be brewing.

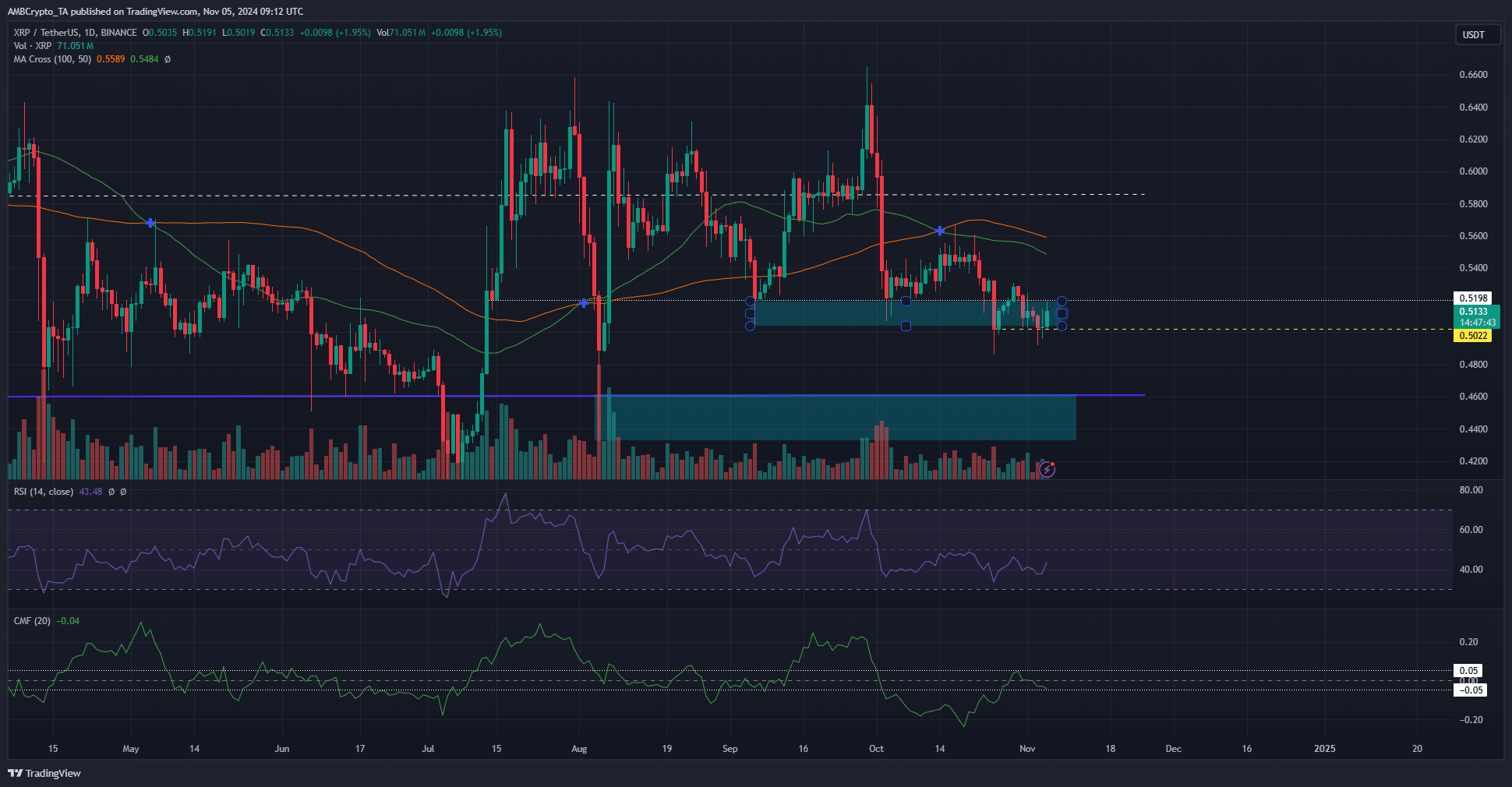

Ripple [XRP] was trading within a key demand zone around the psychological $0.5 support zone. It is well below the mid-range mark of $0.585, another key higher timeframe level. This outlined the HTF bearish bias for XRP.

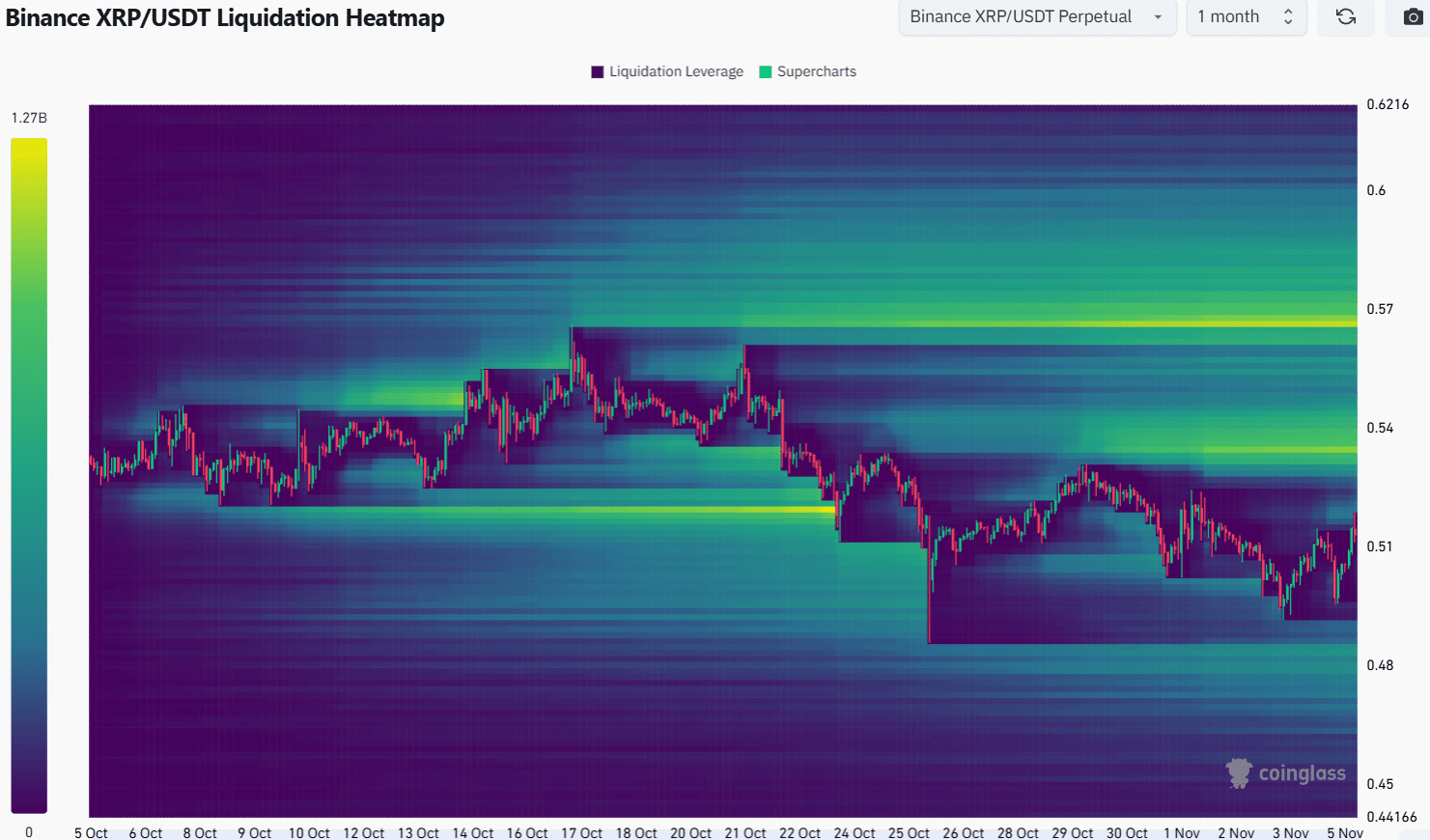

On the other hand, the liquidation heatmap indicated that a bounce toward $0.57 was likely. Were the buyers gaining confidence, or were they waiting for the U.S. election results before making a decision?

The bears were unable to break the $0.502 support

Source: XRP/USDT on TradingView

XRP bulls have resolutely defended the $0.5022 support over the past three weeks. The momentum and selling pressure were working against them but XRP bidders have held on. Yet, the daily and weekly market structures were bearish.

To the south, the lows of the 15-month range at $0.44 beckoned XRP prices. As things stand, such a drop appeared unlikely, although a precipitous Bitcoin correction could send XRP to these levels.

The CMF was at -0.04 and showed capital flow out of the market but not as strongly as it did in October. The RSI on the daily chart has been below neutral 50 for five weeks, showing bearish momentum has been dominant.

Liquidation levels make an argument for a price bounce

Source: Coinglass

The $0.502 and $0.63 levels were the key to the next impulse move for the token. The former was under siege but was defended well so far. The one-month liquidation heatmap showed that the price has collected the liquidity around $0.5 and begun to bounce toward the next targets.

Read Ripple’s [XRP] Price Prediction 2024-25

The liquidity pools at $0.54 and $0.57 were visible bullish targets in the short term that would likely be tested in the coming weeks.

The bounce from $0.5 was a sign that sellers were likely exhausted, but it is unclear if the buyers have the strength right now to force a move toward $0.57.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Credit: Source link