- XRP has declined in the last few days.

- The asset is one of the losers among top assets in the last 24 hours.

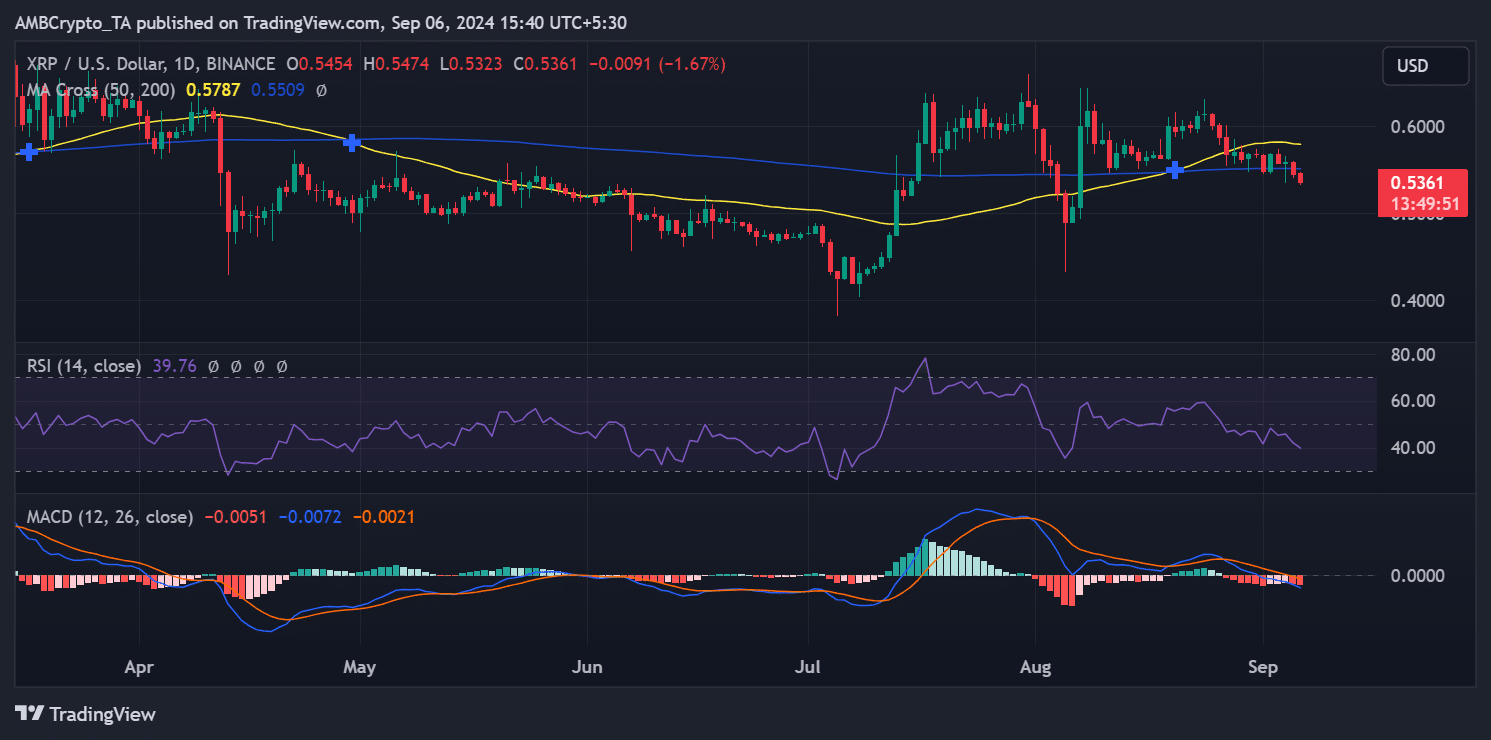

Ripple [XRP] has been facing increasing downward pressure as it struggled to maintain its recent price levels. Trading at $0.5361 at press time, the asset has seen bearish momentum build over the past few weeks.

Technical indicators such as the Relative Strength Index (RSI) and moving averages suggested that the market is approaching oversold conditions. Also, data shows that its supply in profit continued to decline.

XRP braces up for more declines

XRP’s recent price movement highlighted its struggle to regain upward momentum, with the asset trading below both its 50-day and 200-day moving averages.

The 50-day moving average was around $0.5787, while the 200-day moving average is around $0.5509.

This setup shows signs of a potential “death cross,” a bearish signal that occurs when the 50-day moving average crosses below the 200-day moving average.

This crossover is generally viewed as a negative indicator, suggesting that XRP’s downtrend may continue in the near term.

In addition, the asset has failed to break through key resistance levels, further highlighting the lack of bullish momentum and contributing to the overall bearish sentiment in the market.

Source: TradingView

Additionally, XRP’s Relative Strength Index (RSI) currently sits at 39.76, placing it near oversold territory. An RSI below 40 often signaled that an asset faces strong selling pressure and could be undervalued.

While this low RSI could indicate a potential rebound, the weak market momentum suggests that any reversal may be short-lived unless there is a significant increase in buying interest.

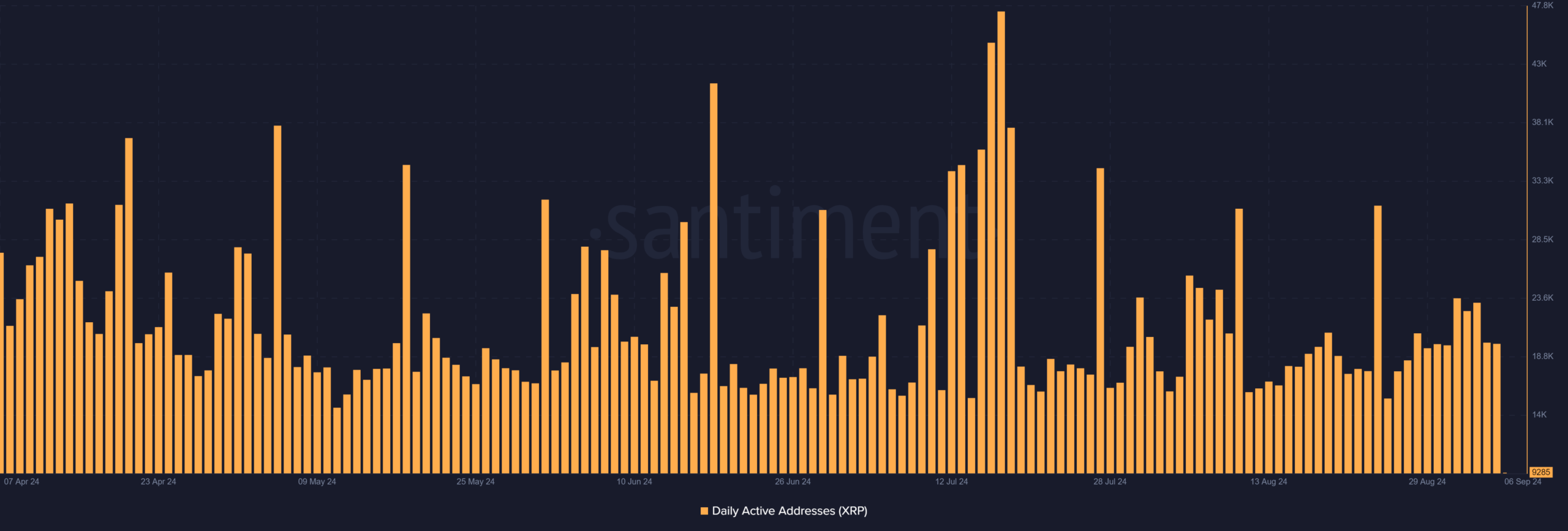

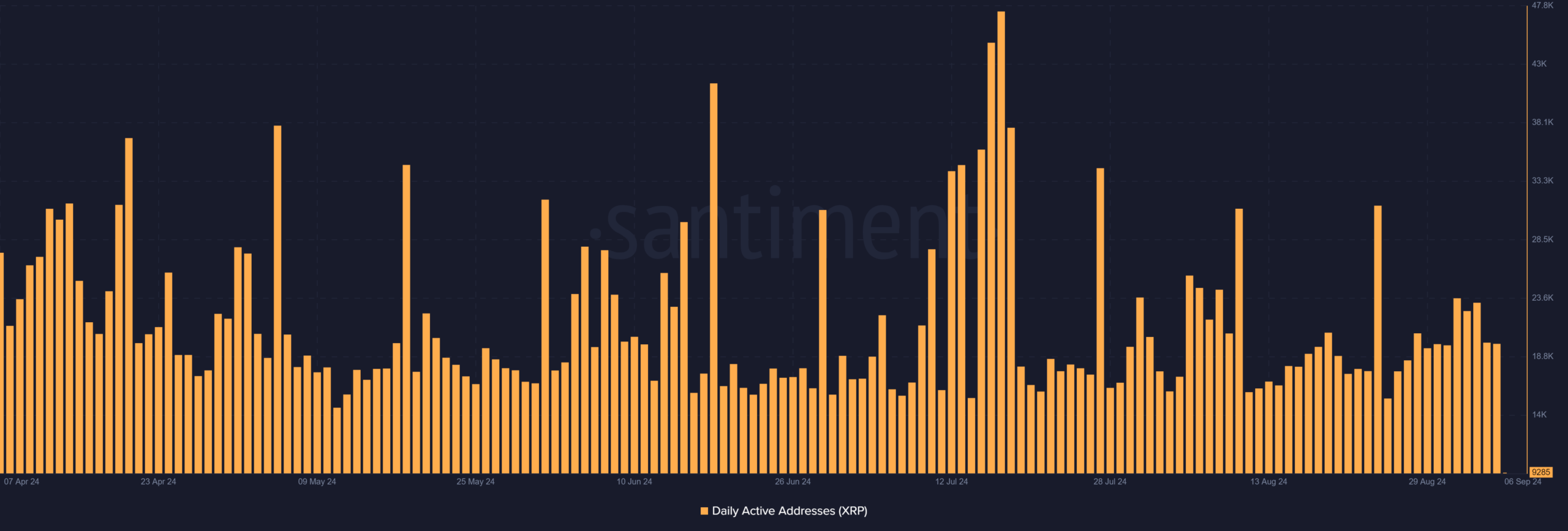

Less address activity

AMBCrypto’s analysis of Ripple’s daily active address chart revealed a decline in recent days. The number has since dropped, after reaching around 23,000 active addresses between the 1st and 3rd September.

In the past two days, the number of active addresses has fluctuated between 20,000 and 19,000.

Source: Santiment

This decline in active addresses suggests that the likelihood of an XRP price rise is weak. A lower level of on-chain activity typically indicates reduced user engagement and market participation.

Without sufficient activity, the case for significant upward momentum in XRP’s price becomes less convincing, as a lack of network engagement can signal waning investor interest and trading volume.

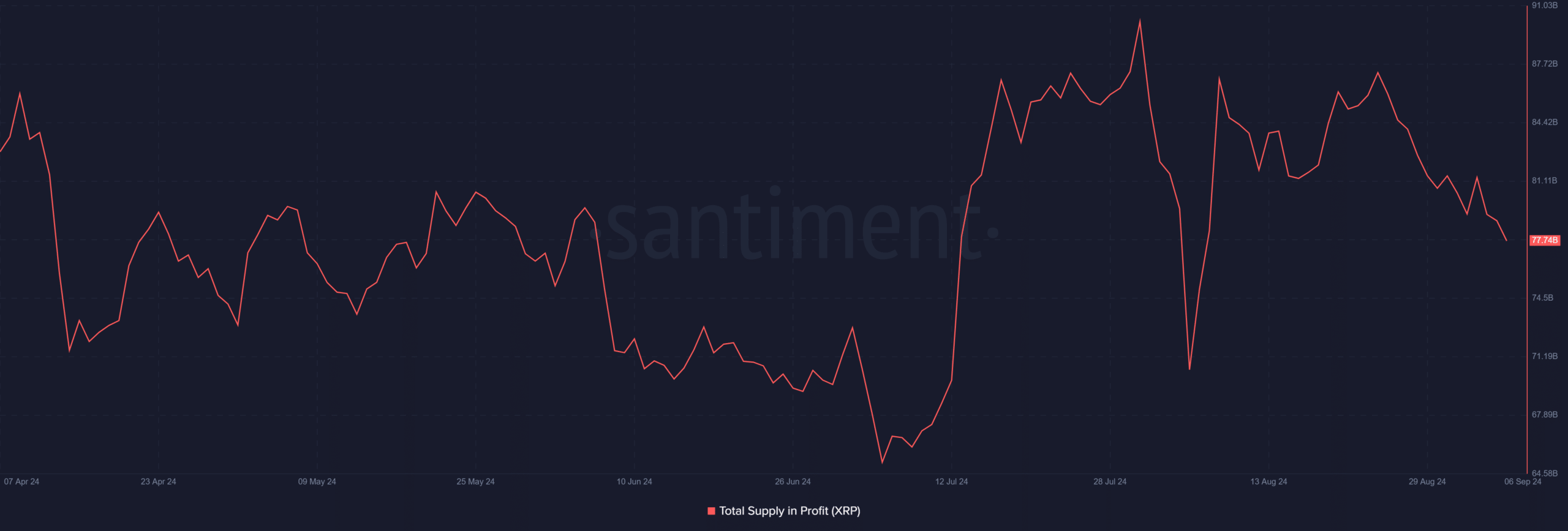

More XRP supply goes underwater

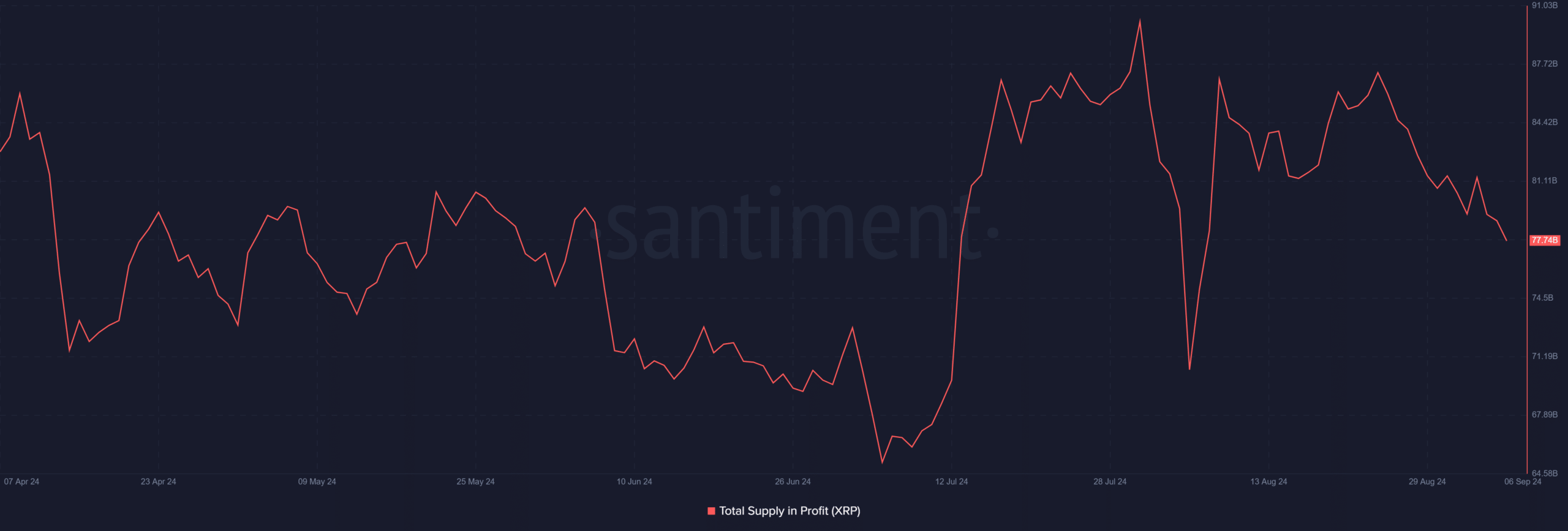

AMBCrypto’s analysis indicated that XRP’s recent price decline has significantly impacted its supply in profit. Around the 24th of August, XRP’s supply in profit was approximately 87.2 billion.

However, the decline has accelerated since then. As of this writing, the supply in profit has dropped to around 77.7 billion XRP.

Source: Santiment

Realistic or not, here’s XRP market cap in BTC’s terms

This sharp decrease highlighted how the continued downward pressure on XRP has led to more holders finding themselves in loss positions.

The rapid decline in the supply in profit reflected the broader bearish trend, with fewer investors able to sell at a profit amid the falling prices.

Credit: Source link