- XRP outpaces BTC’s growth with a massive 490% surge in active addresses since its 2022 low.

- The altcoin retail demand is marking a key shift in its market dynamics as its price approaches a breakout point.

Ripple [XRP] is making headlines again, not just for its price moves but for the crowd behind it. While Bitcoin continues to attract institutional capital, XRP seems to dominate among the retail crowd.

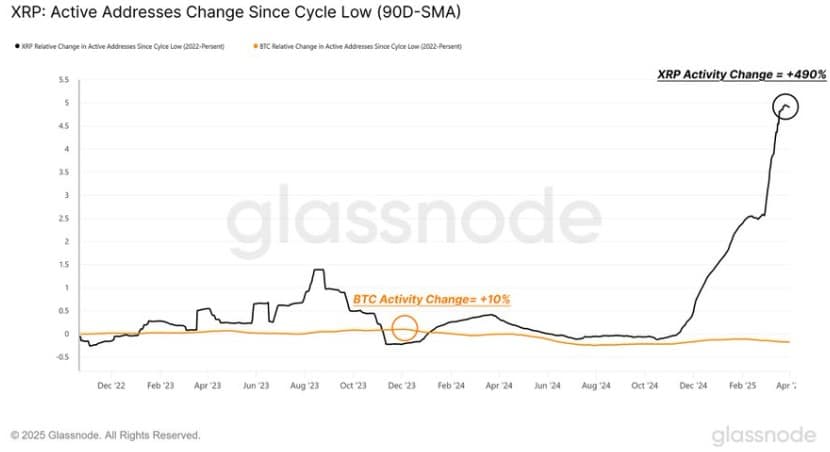

According to AMBCrypto’s analysis of Glassnode data, XRP’s active addresses have surged by 490%since hitting its cycle low in 2022. On the flip side, BTC trading activity has only increased by 10% over the same period.

This drastic contrast signals a sentiment shift among traders. Retail traders are clearly taking a massive bet on XRP this time around.

The difference in on-chain activity confirms that narrative and may affect the way both assets perform during this cycle.

Source: Glassnode

Activity points to retail speculation

The active address spike is not just an on chain metric — it is a tale of sentiment. Growing wallet activity is usually a sign of growing interest from users, especially the smaller market participants.

For XRP, this is a clear signal that retail traders are leaping in with greater confidence.

On the other hand, Bitcoin’s slower growth in active addresses indicates a more established and balanced wave of interest, likely due to institutions and institutional investors.

This divergence could explain the contrasting volatility and risk profiles of the two assets in recent months.

Can retail momentum sustain?

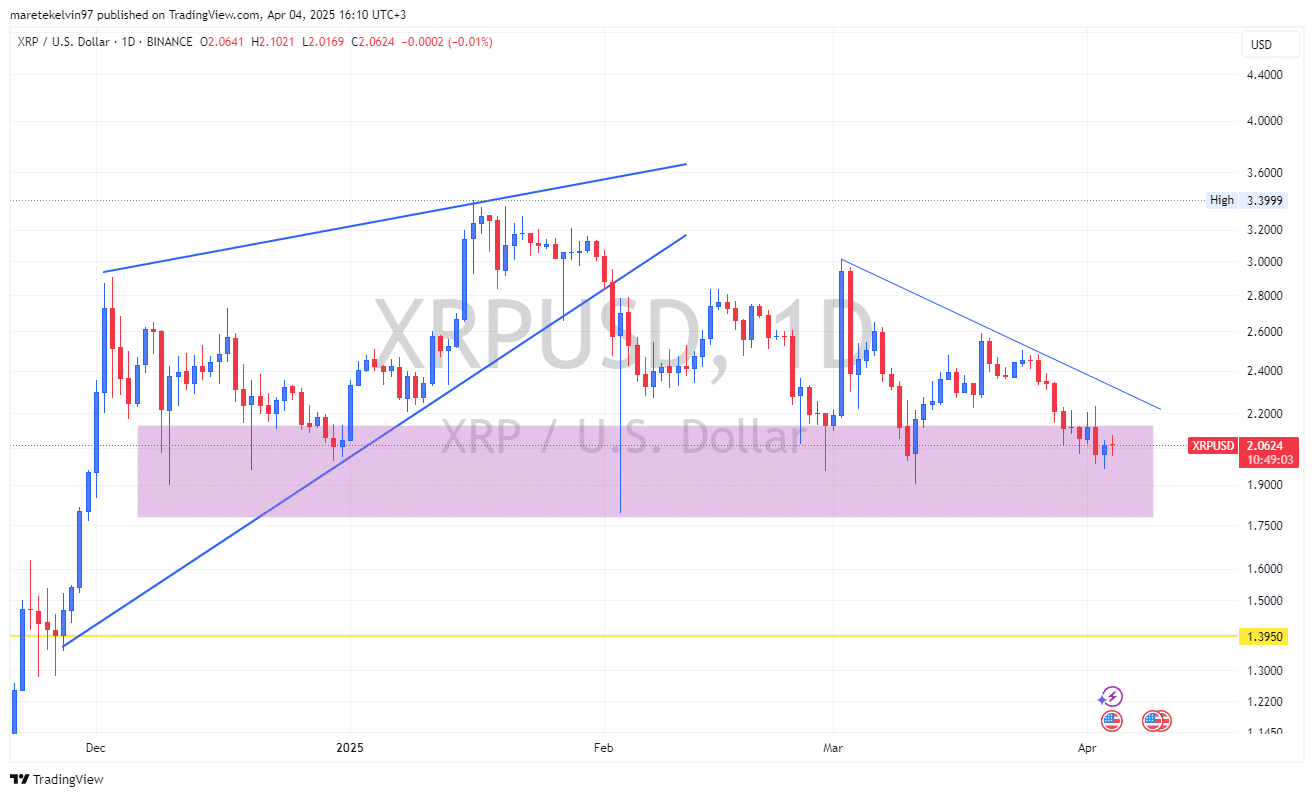

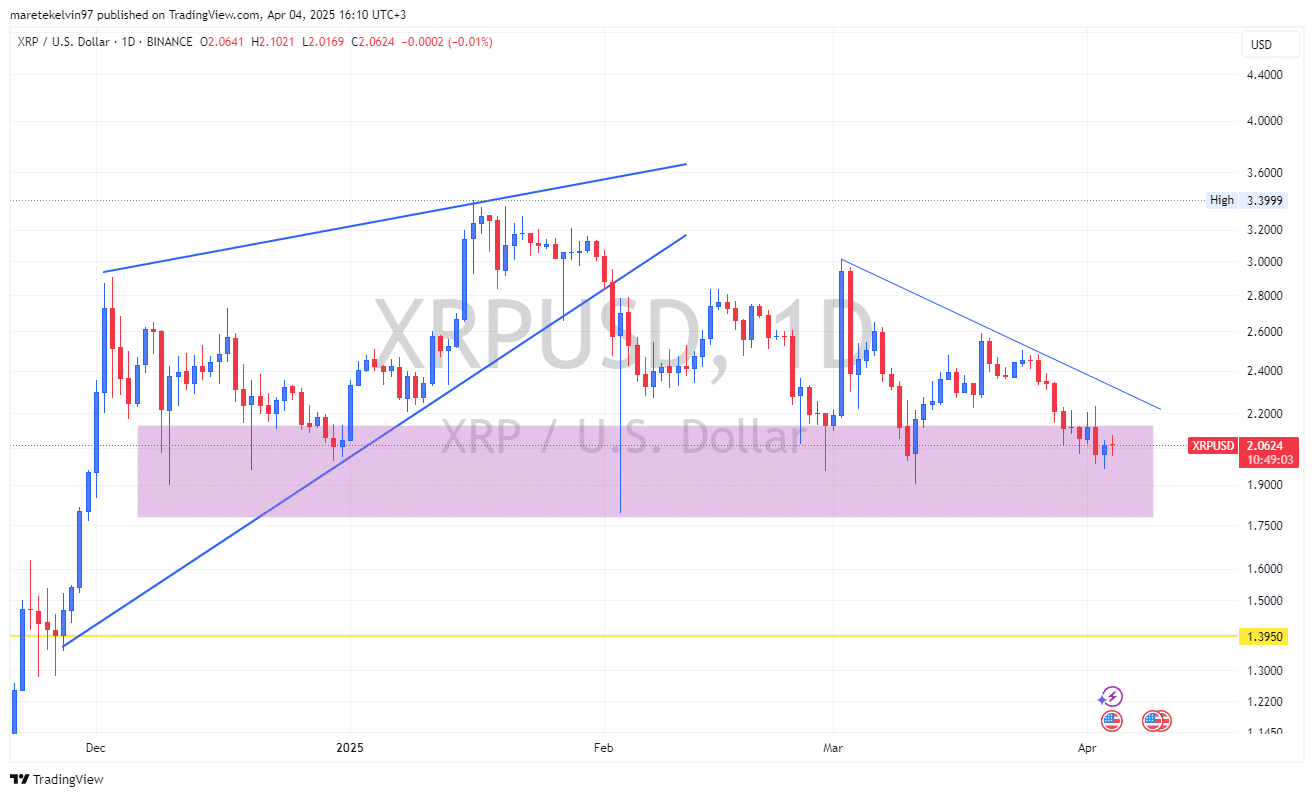

As of writing, XRP was trading at around $2.07. The altcoin’s prices have remained firm despite wider market corrections, a potential indication of support from its retail base.

Technically, the altcoin prices are a consolidating in descending triangle pattern. The positive development for the Ripple community, however, is that the phase is nearing an end, with the $2.0 price zone still holding on.

Source: TradingView

With active participation still on the rise, the asset may experience further upside if demand continues to be steady.

However, XRP’s price trajectory is also vulnerable to rapid shifts in sentiment — a common trait in retail-driven assets. If retail interest fades or profit-taking kicks in, XRP could see swift corrections.

The current cycle is setting up a clear contrast. Bitcoin is moving with institutional backing, while XRP is charging ahead with retail support.

Whether that continues will depend on market conditions and broader investor behavior.

But one clear sign is evident — XRP is no longer just riding Bitcoin’s back. The altcoin is carving its own path this cycle, and retail demand is at the heart of it.

Credit: Source link