- XRP’s $1 milestone seemed uncertain, as daily active addresses declined significantly.

- Ripple’s trading volume dropped from almost $3 billion to around $207 million.

After months of consolidation, Ripple [XRP] has reclaimed the psychological $1 level, marking a significant milestone for the cryptocurrency.

However, this achievement has been accompanied by a sharp decline in trading activity, with volumes dropping from their recent peak.

While the price rally reflects renewed investor interest, the accompanying volume crash raises concerns about sustainability.

XRP: $1 surge and market context

XRP’s ascent to $1 comes after a prolonged period of sideways trading, with the cryptocurrency breaking through key resistance levels.

The price has reached as high as $1.10, supported by strong buying activity earlier in the rally.

The broader market’s bullish sentiment, led by Bitcoin’s recent rally, has played a role in XRP’s resurgence.

However, XRP’s relative strength index (RSI) indicated overbought conditions at 82.69, signaling that the rally may be losing steam.

Source: TradingView

The MACD showed bullish momentum on the technical front, although the histogram suggested it could start tapering off.

Meanwhile, XRP’s volume was 5.49 billion on the 20th of November, a sharp decline from the peak of over 24 billion seen just days earlier. Such a steep drop in volume raises red flags about the sustainability of XRP’s breakout.

The impact of the 18 billion volume decline

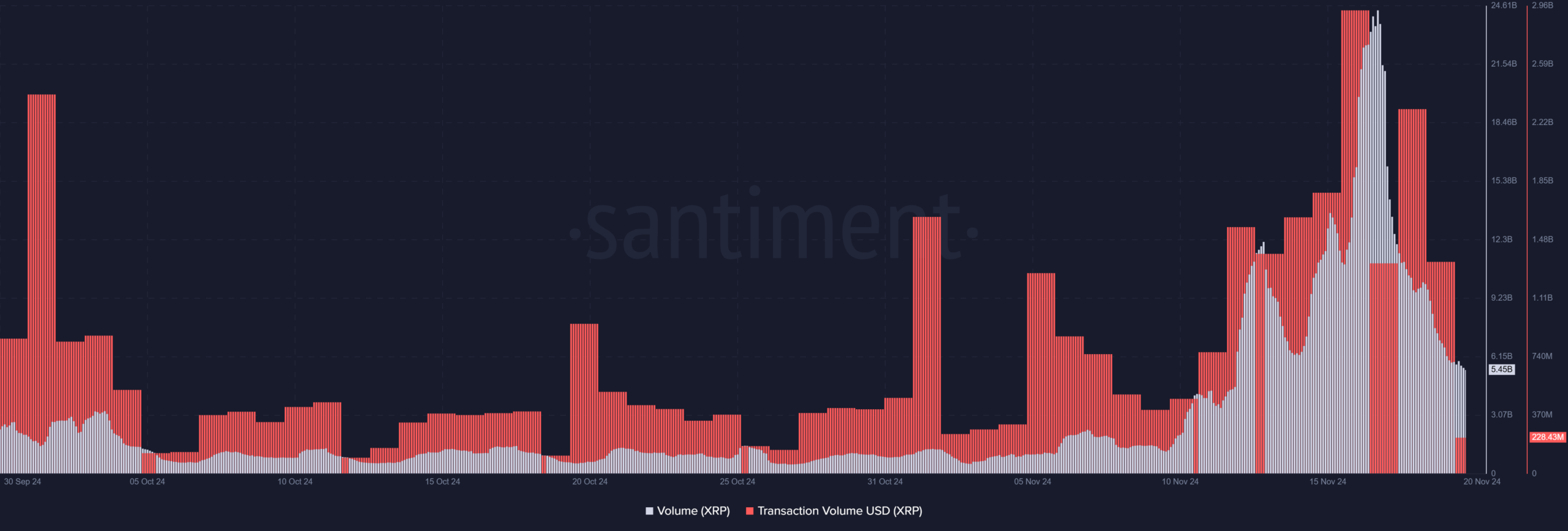

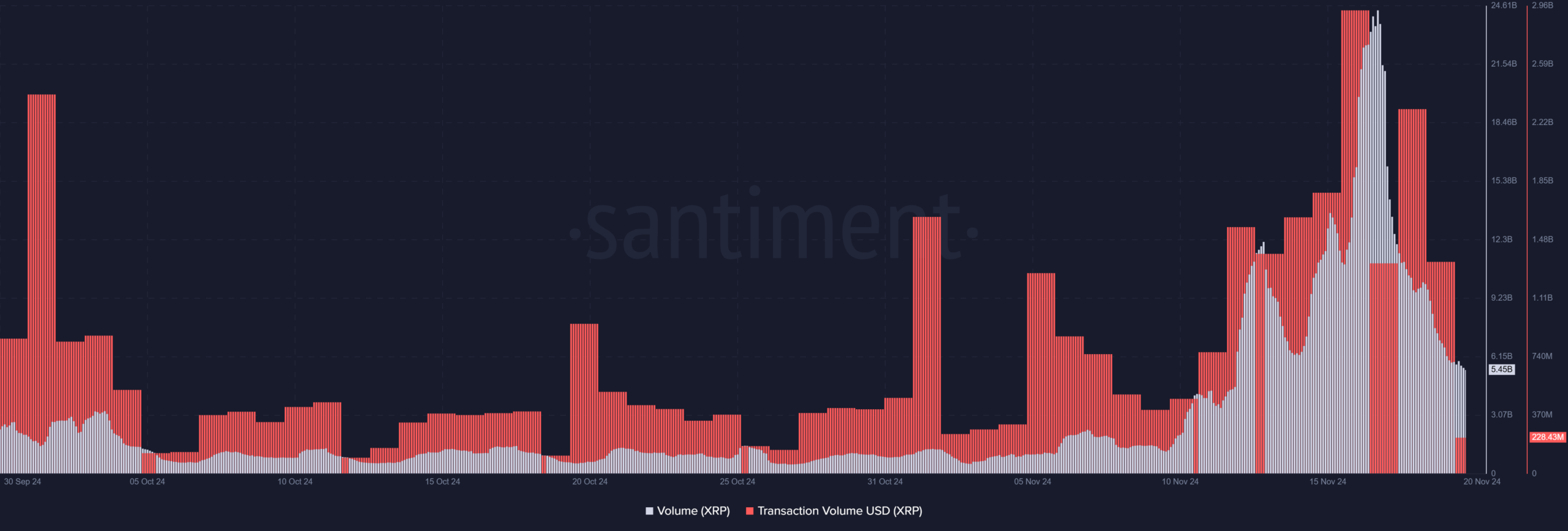

Santiment data showed that XRP’s trading volume had fallen significantly since its peak during the rally.

AMBCrypto’s analysis showed that the trading volume hit over 24 billion on the 17th of November but had fallen to around 5.4 billion as of this writing.

Also, an analysis of the trading volume showed a fall from over $2.9 billion to around $207 million as of this writing.

Source: Santiment

This volume drop highlighted a potential waning of market enthusiasm, often coinciding with traders’ profit-taking.

Historically, volume surges have accompanied sustained price rallies, but the recent decline suggests that buying pressure may be fading.

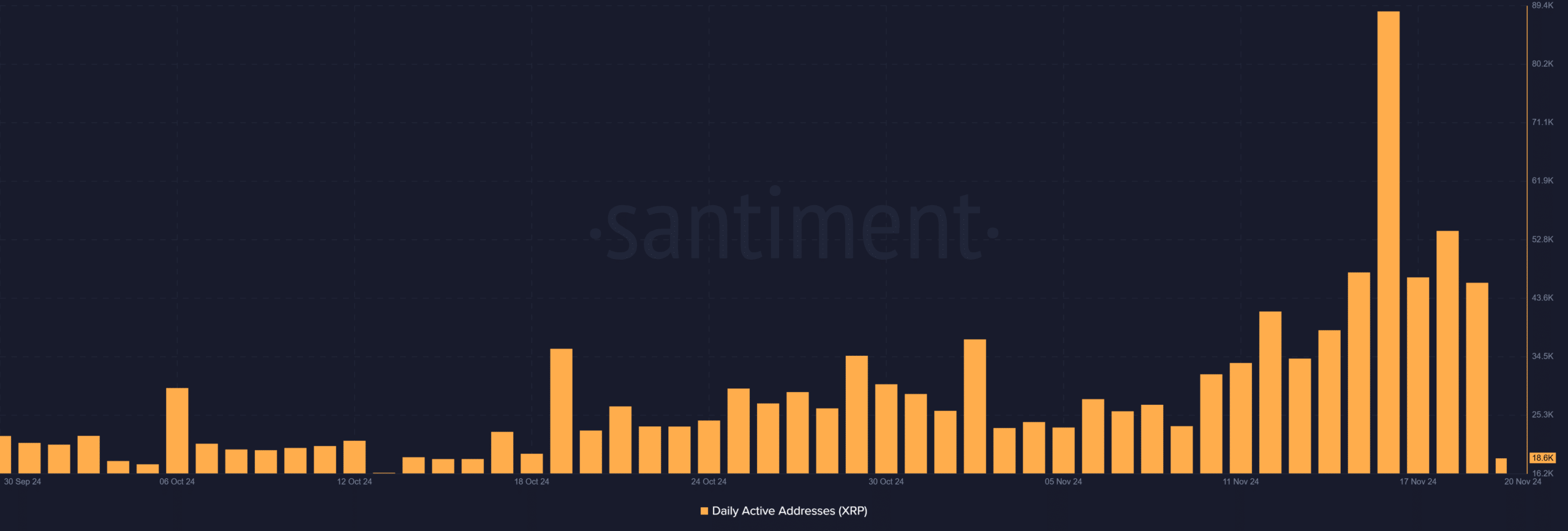

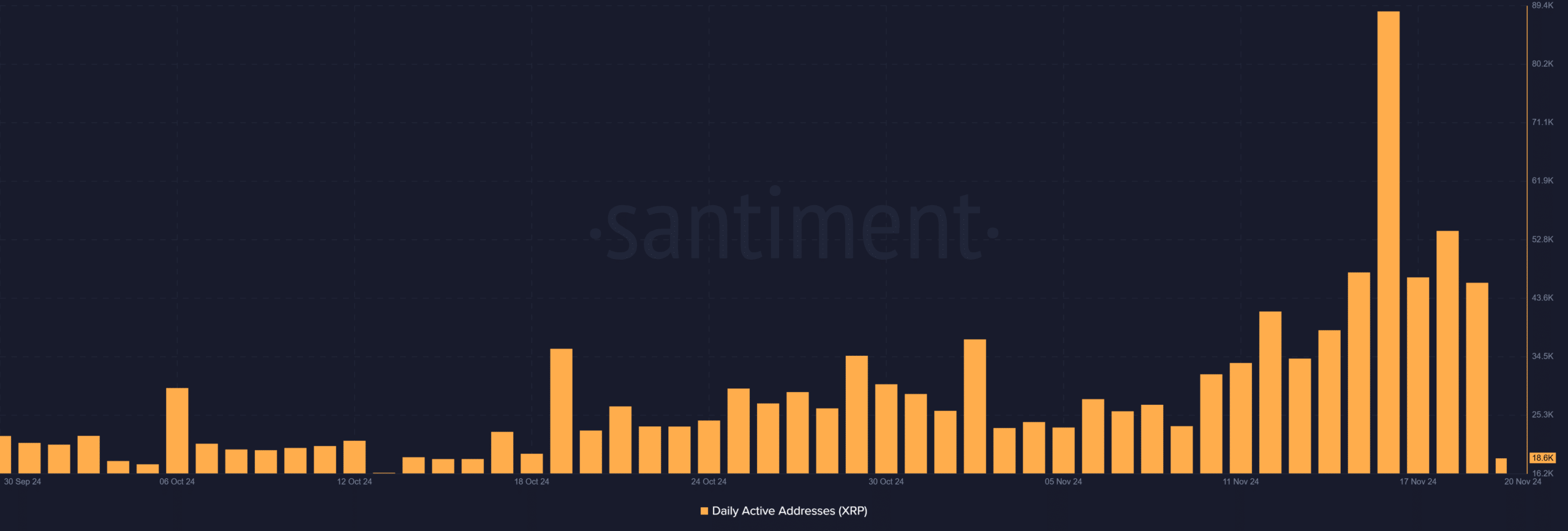

Furthermore, daily active addresses, another critical metric, have dropped from their recent highs.

This indicated that fewer participants have been engaging with the XRP ledger, which could signal reduced demand in the short term.

For XRP to sustain its position above $1, it will need renewed participation and consistent trading activity.

Source: Santiment

Factors driving the volume decline

The significant reduction in trading volume can be attributed to several factors. Profit-taking behavior is likely the primary driver, as traders lock in gains following XRP’s $1 breakout.

Additionally, broader market sentiment may be shifting toward caution, especially as other cryptocurrencies experience similar declines in volume after recent rallies.

Can XRP sustain its rally?

XRP’s ability to maintain its price above $1 depends on several factors. The cryptocurrency must hold its critical support level at $1, as a breach could trigger further sell-offs and a return to consolidation.

Resistance at $1.15 will be the next key level for a potential rally continuation.

Realistic or not, here’s XRP market cap in BTC’s terms

The broader market sentiment will also play a role, as Bitcoin and Ethereum’s performance often influence altcoin momentum.

Additionally, on-chain metrics such as daily active addresses and transaction volumes must show signs of recovery for XRP’s rally to gain renewed strength.

Credit: Source link