- Bitcoin short-term holders transacted 170,000 Bitcoin, which can cause price fluctuations.

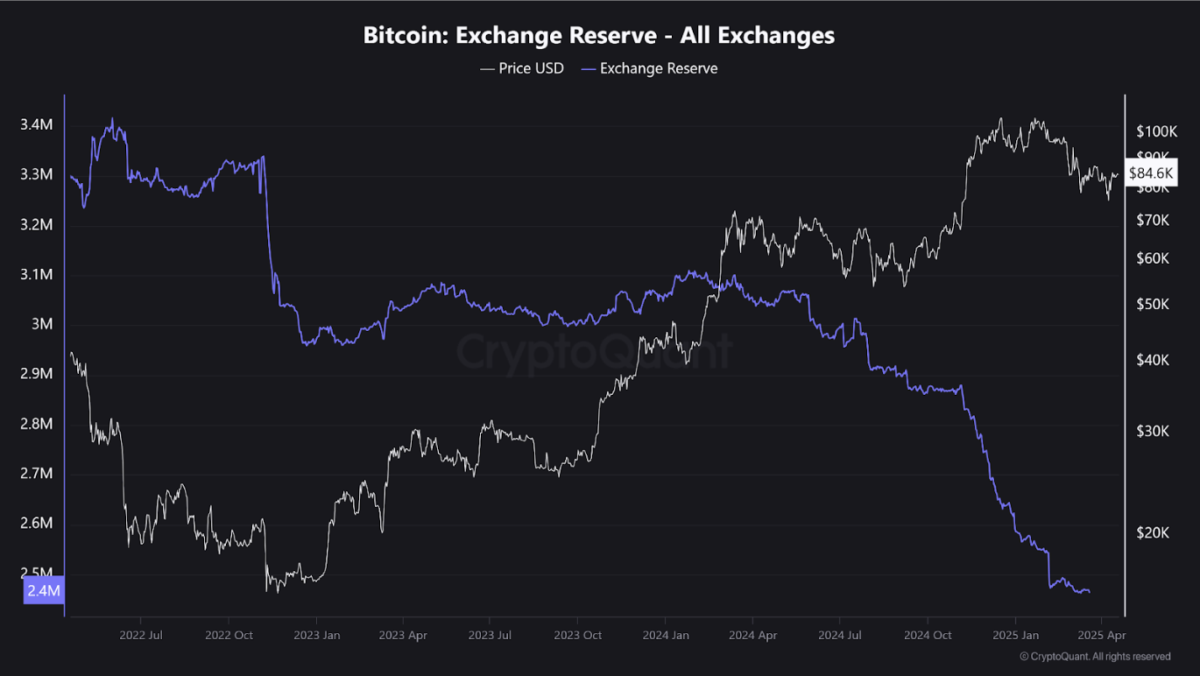

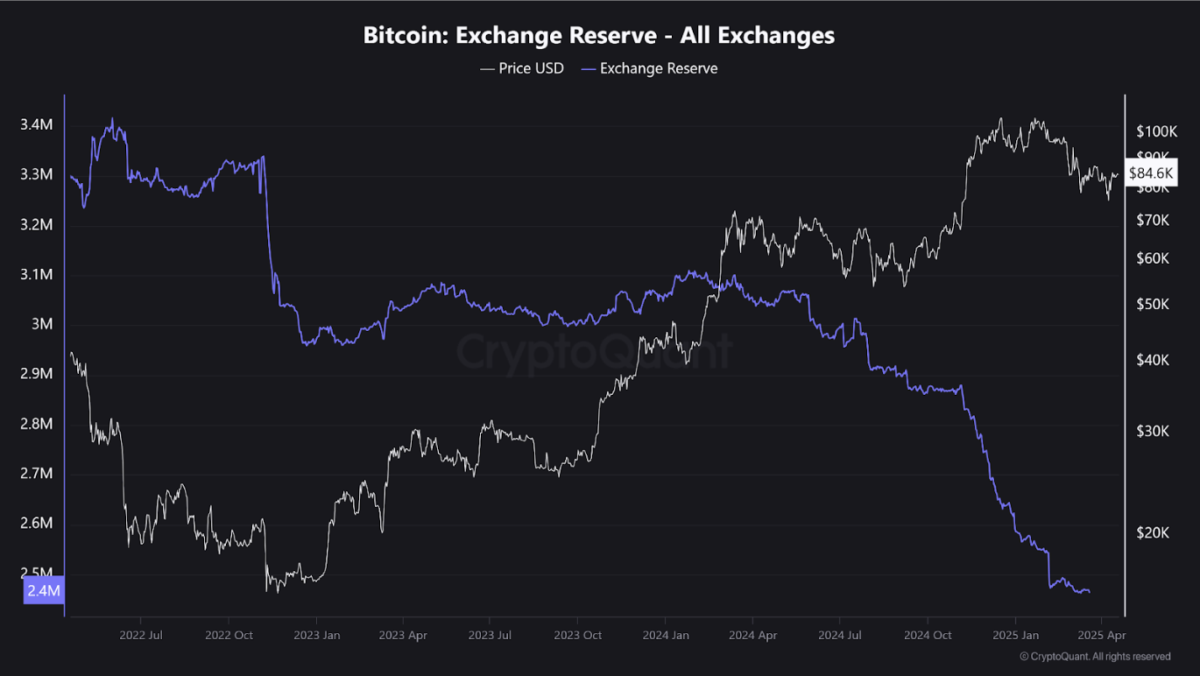

- The exchange reserves are now at their lowest level in years, while the number of active addresses remains relatively high.

Bitcoin’s price has continued to trade above $84,000, but the fundamentals point towards an increase in volatility soon. According to data from CryptoQuant, short-term holders started to offload BTC onchain; meanwhile, exchange reserves are still declining. These combined actions point to market consolidation.

CryptoQuant analysts identified that 170K BTC have been transferred by those who bought BTC three to six months ago. Historically, such spikes from short-term holders (STH) cohorts have led to increased fluctuations, either upward or downward.

As highlighted by Mignolet on April 18, volatility is again expected around these holders when they rebalance their portfolios. Analysts, including Crazzyblockk, pointed out that while STHs are transacting 930 BTC to exchange per day, long-term holders (LTHs) are transacting only 529 BTC/day.

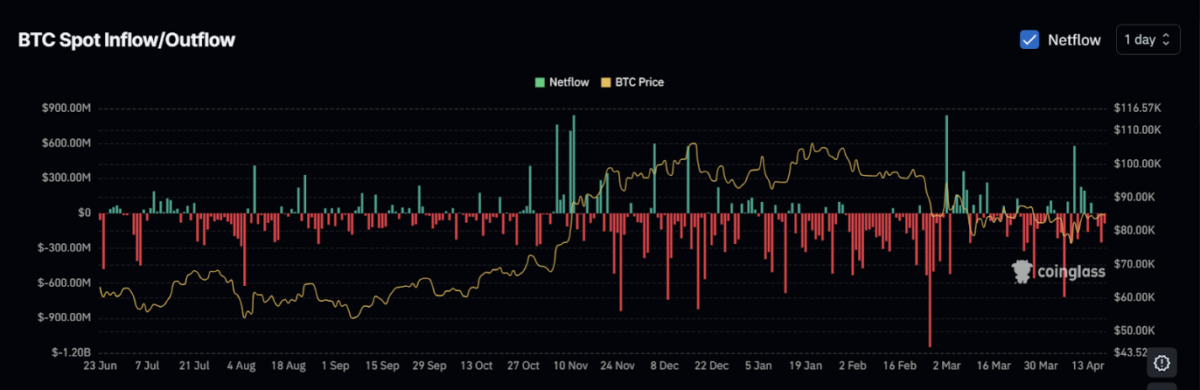

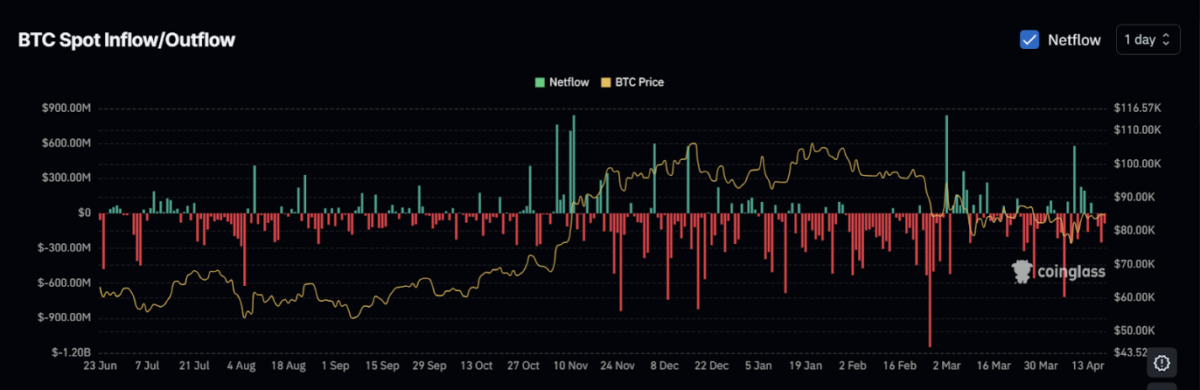

This is in line with the latest spot inflow/outflow data from CoinGlass, which has shown relatively small but steady outflows from exchanges. Almost all the daily volumes have turned red, indicating that investors are shying away from keeping their BTC on centralized exchanges. The visible decline is echoed by demand for self-custody, which tends to rise when people are uncertain about the future or, let alone hoarding, as with long-term investment strategy.

Exchange Reserves Hit Multi-Year Low, Despite Active Address Uptick

Bitcoin’s exchange reserves are currently at a three-year low at 2.4 million BTC. The gradual decline depicted by CryptoQuant reserve means that the community continues shifting their holdings from exchanges, which aligns with the latest trend. This behavior usually occurs before price rallies but may also be associated with holders’ hesitancy as they prepare for high volatility.

Even after such a trend, the number of active addresses of Bitcoin is not very volatile and stands at a moderate average of nearly one million daily. This is a testimony to continuous user engagement and network utilization, as the price has declined and set a recent high. Although not outright bullish, consistent address activity can support levels by establishing evidence of active network use in the space.

The 24-hour volume has declined by almost 22% and reached $20.21 billion, adding weight to the argument that the market is currently inactive. However, such low-volume periods are typically typical just before the highs or the lows, particularly when associated with a declining exchange supply and increasing derivatives liabilities.

Open Interest Rises While Analysts Map Strategic Entry Zones

Open interest in BTC futures remains at $60 billion, which shows great trader participation despite the price consolidation that has characterized the market over the last few weeks. The metric represents the total value of the outstanding futures contracts, which has been rising since the end of 2023.

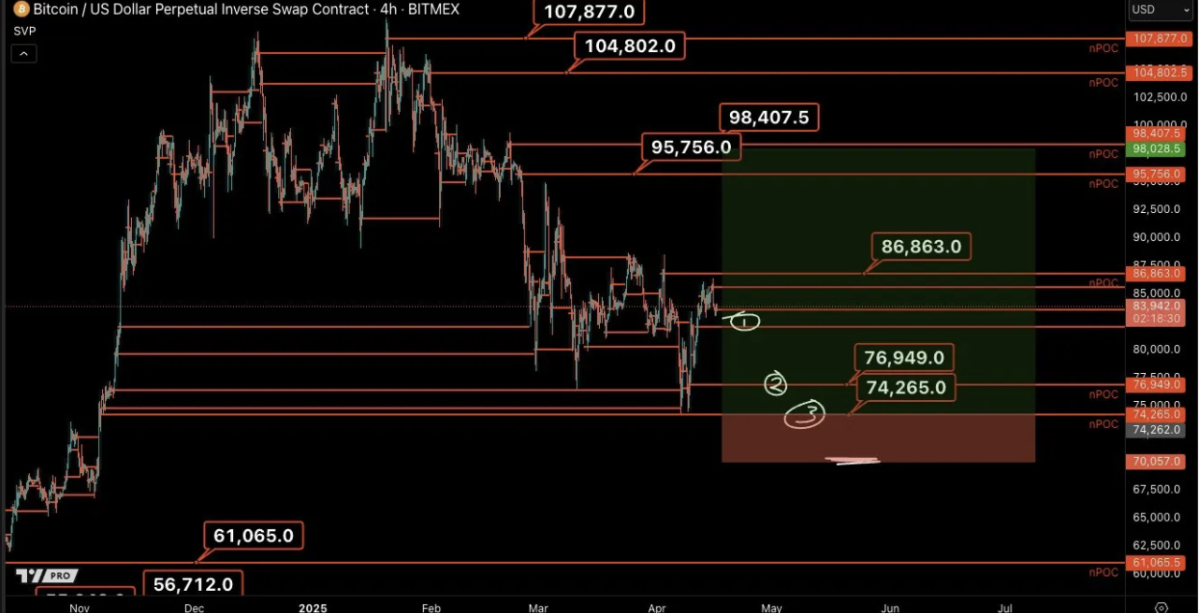

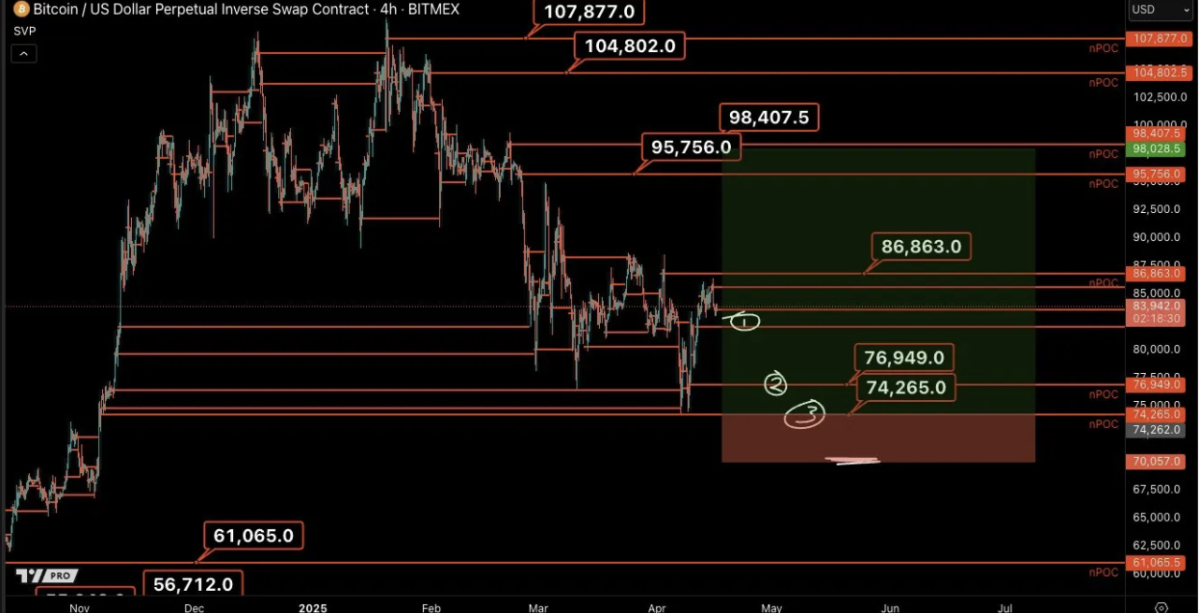

High levels of open interest are indicative of a large price move in

the future, particularly when positions are added without any corresponding rise in price. Technical analyst Castillo Trading pointed to $75,000-$82,000 as key support levels, stating that long entries at $76,949 and $74,265 could yield strong rebound potential.

The analysis also showed several naked points of control (nPOCs) at higher prices, such as $95,756 and $107,877, which, in case of a further BTC upturn, are likely to behave as the magnet.

Credit: Source link