- Solana’s long liquidations totaled $11 million on 2nd April.

- Its futures open interest has declined since the beginning of the month.

Solana [SOL] witnessed a surge in long liquidations on 2nd April, as the coin’s price fell below $180 during that day’s trading session. According to Coinglass data, SOL long liquidations totaled $11 million, marking a two-week high.

Liquidations exist in a coin’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain the position.

Long liquidations occur when the value of an asset suddenly drops, forcing traders who have open positions in favor of a price rally to exit their positions.

In comparison, short liquidations totaled $3 million on the same day.

SOL’s futures market performance

AMBCrypto’s assessment of the activity on SOL’s futures market revealed a steady hike in bearish sentiments since the beginning of the month.

Firstly, the coin’s futures open interest, which measures the total number of futures contracts that have yet to be settled or closed, has trended downward since 1st April.

At $2.88 billion as of this writing, SOL’s futures open interest has dropped by 20% since the beginning of April, per Coinglass data.

When an asset’s open interest falls in this manner, it suggests that market participants are exiting their trading positions without opening new ones.

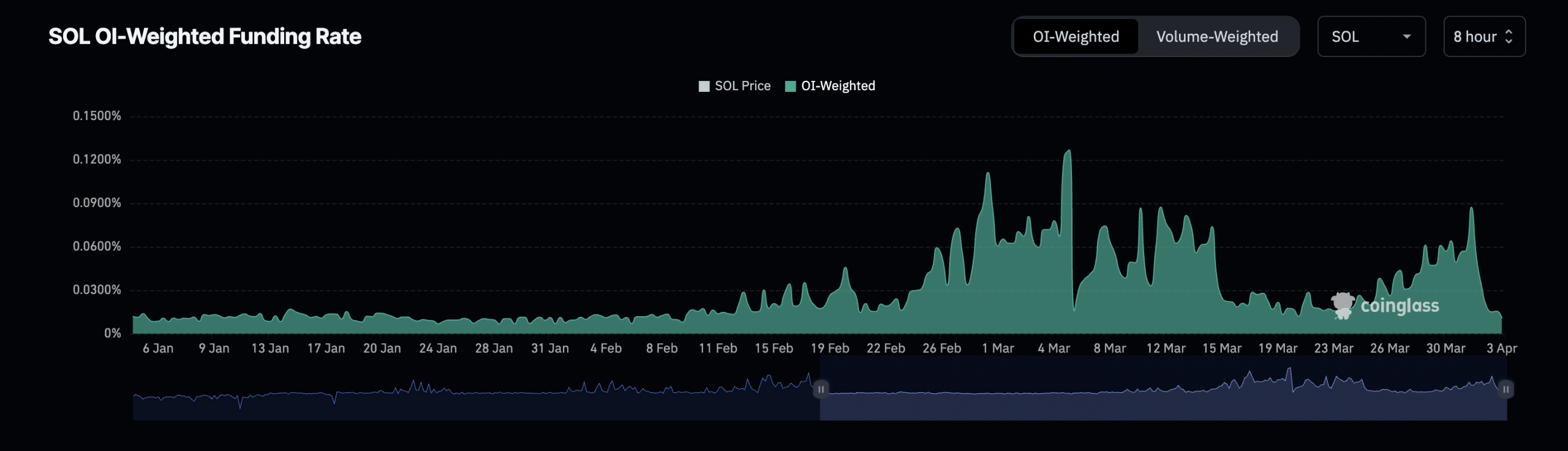

Although its funding rate across cryptocurrency exchanges remained positive, it had declined by almost 90% since 1st April and was spotted at a 60-day low at press time.

Source: Coinglass

The decline in SOL’s funding rate is noteworthy as it suggests the demand for long positions is waning. It signals that long traders are exiting their positions primarily for profit.

When long traders start to pull back like this, it means that the market is becoming overheated. It also suggests that bullish momentum is weakening.

This often leads to a drop in buying pressure, eventually resulting in a decline in the underlying asset’s price.

Read Solana’s [SOL] Price Prediction 2024-2025

Is SOL losing its rep?

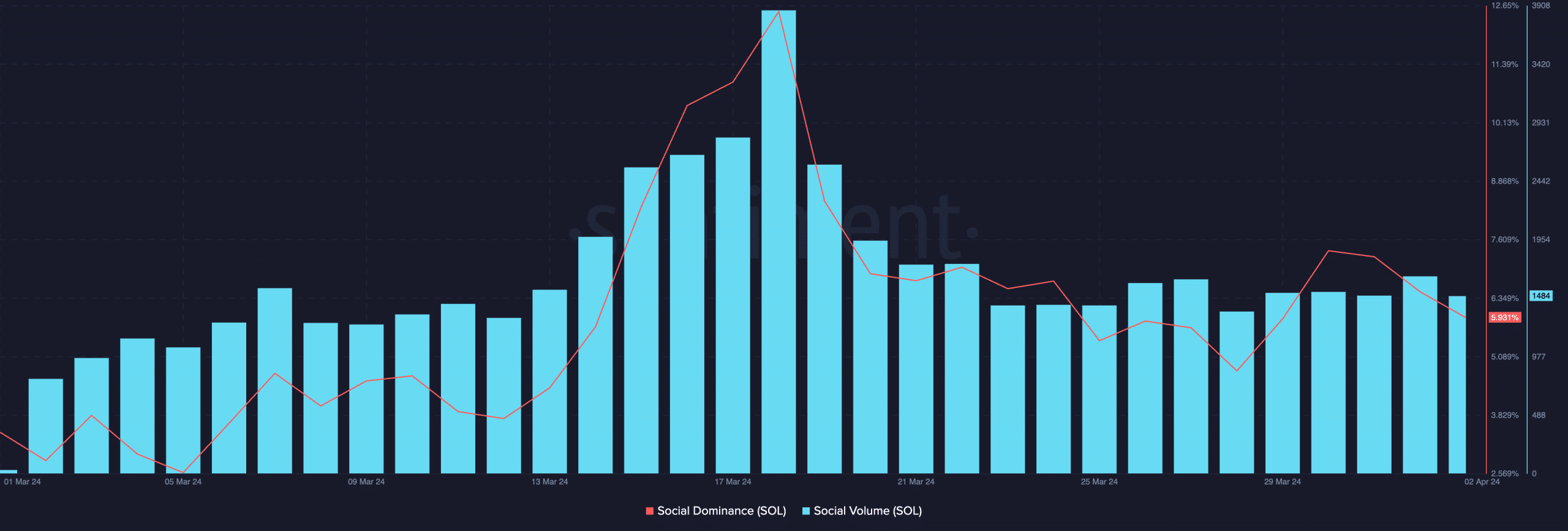

The gradual spike in bearish sentiment in the SOL market coincides with a decline in the coin’s social activity. According to Santiment data, SOL’s social dominance and social volume have dropped by 50% and 57% in the past two weeks.

Source: Santiment

A decline in an asset’s social activity means that the asset enjoys less engagement across various social media platforms. This is common when bullish sentiment begins to decrease.

Credit: Source link