- MKR’s price decoupled from ETH as MakerDAO sold some tokens.

- On-chain and technical analysis suggested a bounce to $3,545 when the selling pressure halts.

For the past two weeks, a certain multisign wallet, linked to MakerDAO, has moved $14.4 million worth of MKR to different exchanges.

According to Spot On Chain, some platforms the tokens landed on were Binance [BNB], Coinbase, and Kraken.

A multisign wallet is a short form for a multi-signature wallet that acts as a storage option for organizations. To unlock assets from this kind of wallet, two or more private keys must be administered.

Back to MakerDAO’s activity. One thing AMBCrypto noticed was that MKR’s price fell on every occasion that the project made a sale.

MKR can’t match ETH

At press time, MKR changed hands at $2,952, representing a 3.84% decline in the last 24 hours.

Interestingly, the token had a different movement from Ethereum [ETH], which it seemed to have a strong correlation with.

As of this writing, ETH’s price was $3,216— a 1.48% increase within the same period MKR dropped.

Findings from our end showed that the multisign wallet still holds 21,928 MKR tokens, meaning that more exchange deposits might take place going forward.

If this happens, ETH might continue to decouple from MKR, and the price of the latter might drop below $2,800. But a further drop could be a good thing for the token’s value.

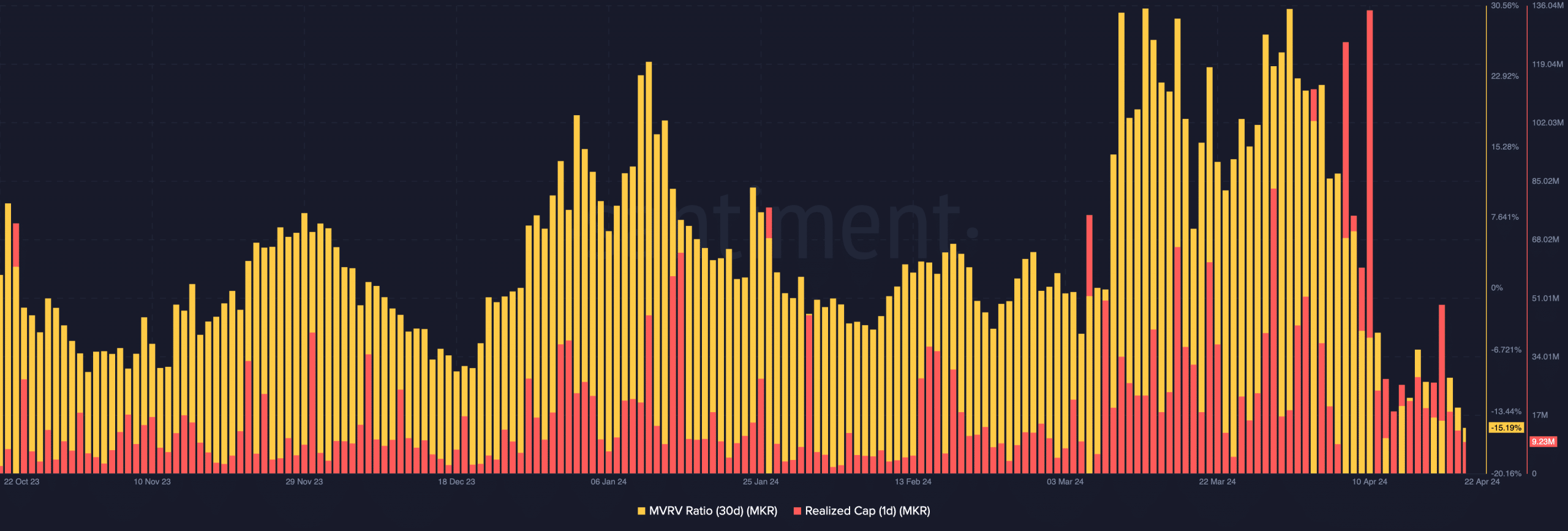

This was because of the signal shown by the Market Value to Realized Value Ratio (MVRV). This metric tracks profitability and the perceived valuation of a token.

Data from Santiment showed that the 30-day MVRV ratio was -15.19%. Historically, when the metric hits a reading like this, the price bounces.

Should this happen again, the price of MKR could rise to $3,545 within a few weeks. Furthermore, the one-day Realized Cap shared this sentiment.

Source: Santiment

If selling stops, the price will rebound

At press time, the Realized Cap was down to 9.23 million. This decline was proof that old tokens were realizing profits.

However, the decline also indicates MKR was undervalued, relative to its historical transaction value.

In addition, this signals a potential bottom for the price. Therefore, MKR might not need to depend on ETH in the short term to find its direction.

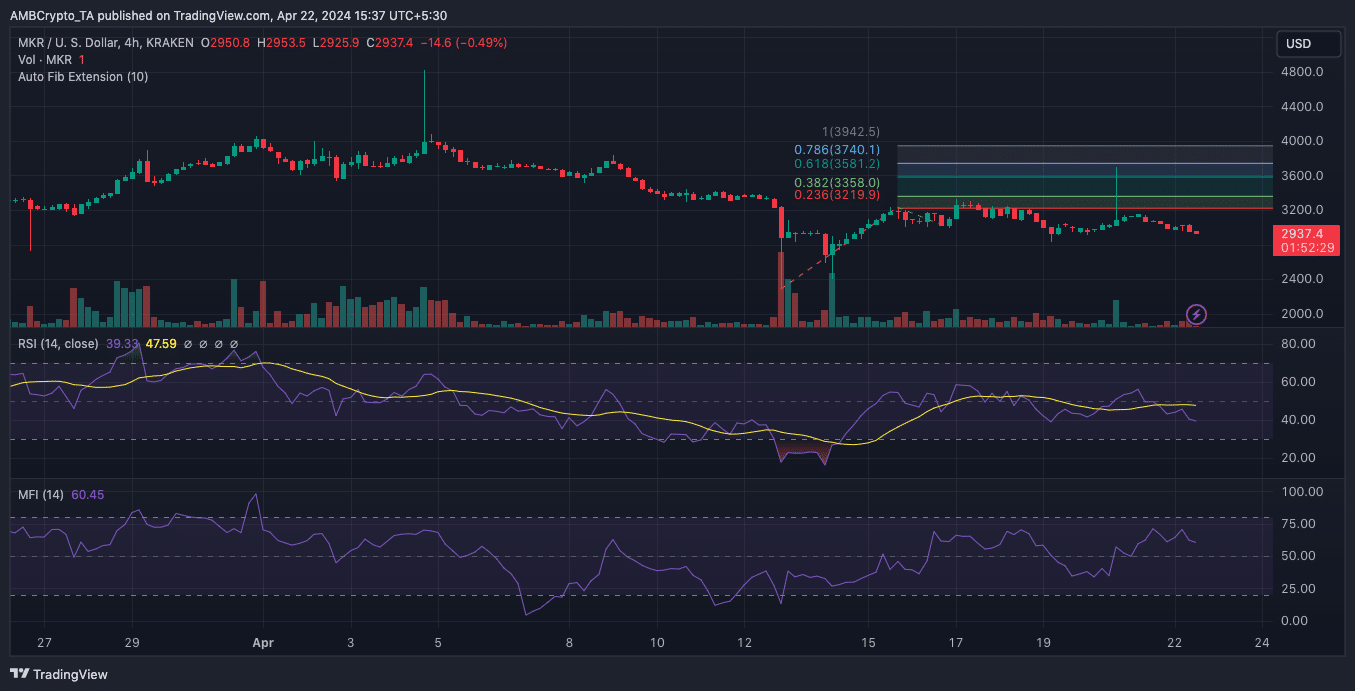

From a technical perspective, the Relative Strength Index (RSI) had dropped below the zero midpoint. This suggested a bearish momentum for the token. As such, a further price decline could be on the cards.

Realistic or not, here’s MKR’s market cap in ETH terms

But if the RSI taps 30.00, MKR would be deemed oversold, and a rebound could be next. Should this be the case, the 0.786 Fibonacci indicator showed that the price might climb to $3,740 in the short to midterm.

Source: TradingView

However, before the projected, hike, MKR’s value might fall as the Money Flow Index (MFI) revealed that capital was flowing out of the cryptocurrency.

Credit: Source link